XM Forex Broker Review 2023

XM offers low fees & good trading conditions. But should Kenyan traders choose XM? Let's find out!

XM is a global forex & CFD broker that has been in the market since 2009. Trading Point Holding, which is XM’s parent company, has two units, XM and Trading.com.

They are one of the popular brokers globally, known for wide 1000+ trading instruments, bonuses up to $500, low spread accounts, and good trading conditions.

Overall, XM has good trading platforms, is regulated by Tier 1 regulators, has a wide variety of trading instruments including 356 CFD options and 57 currency pairs in Forex for both retail and institutional clients, and five cryptocurrency CFDs but no ETFs products till now.

All these make XM a good broker on paper, for the traders in Kenya. But should you really choose them?

Let’s look at all their pros & cons in detail.

XM Kenya Pros

- No Deposit & Withdrawal Charges.

- No Commission on trading.

- Offers MT4 & MT5 trading platforms

- Minimum deposit is $5.

- Allow Forex Scalping.

XM Kenya Cons

- Inactivity fees.

- Not accepting clients from USA.

- Dealing Desk forex broker.

Table of Contents

XM Broker – A quick look

| 👌 Our verdict | #2 Forex Broker in Kenya |

| 🏦 Broker Name | XM Global |

| 💵 Average EURUSD Spread | 0.8 pips (with Ultra Low Account) |

| 📅 Year Founded | 2009 |

| 🌐 Website | www.xm.com |

| 💰 Minimum Deposit | $5 |

| ⚙️ Maximum Leverage | 888:1 |

| ⚖️ Regulation(s) | ASIC, CySEC |

| 🛍️ Trading Instruments | Forex Trading, CFDs on Commodities, Cryptos, Metals, Indices, Shares |

| 📱 Trading Platforms | MT4 and MT5 for PC, Mac, Web, Android |

| 📒 Demo Account | Yes |

| 💰 KES Base Currency | No |

| 📒 Demo Account | Yes |

| 💰 KES Base Currency | No |

Is XM Forex Broker Safe?

XM is regulated with these following global regulators.

We have only covered regulators that we consider as Tier 1 & 2. We did not consider any Offshore regulators:

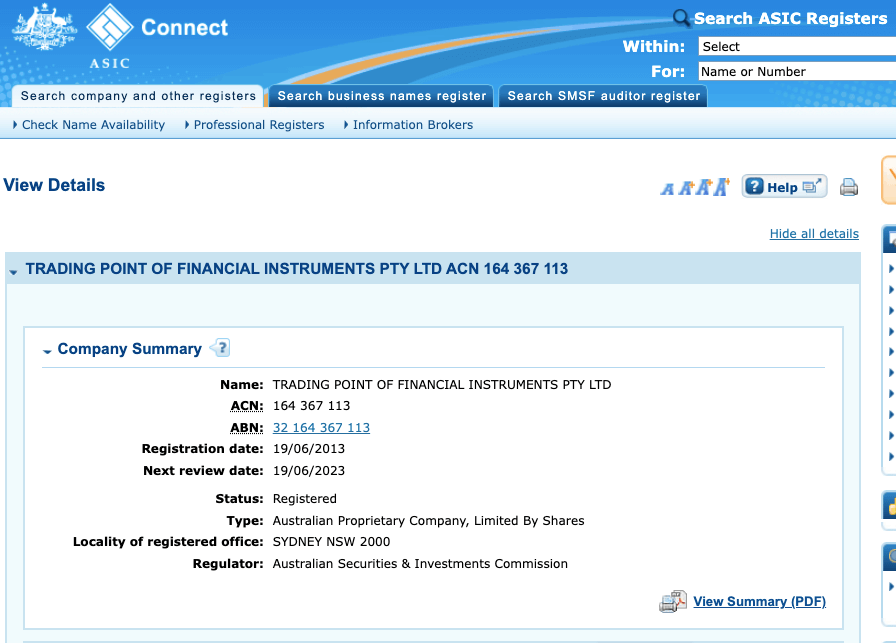

- Australian Securities & Investments Commission (ASIC): XM is regulated with the Australian Securities and Investment Commission (ASIC) with license number 443670.

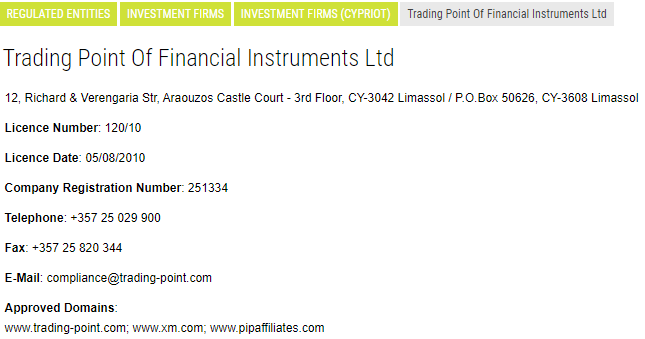

- Cyprus Securities and Exchange Commission (CySEC): XM is also regulated with CySEC (Cyprus Securities and Exchange Commission) under license number being 120/10.

For the safety of funds, XM also follows protocols that keep the investor funds quite safe. There is a segregation of client funds. The client’s money gets transferred to a separate client bank account. These accounts are not on balance sheets and in case of any insolvency of the company, clients’ accounts cannot be used by the broker.

The bank accounts of XM are also with big banks that have good industry reputations.

As XM is regulated with tier 1 and tier 2 regulatory bodies, they have to maintain and oblige strict financial requirements. Enough liquid capital is kept to cover the client’s funds and any fluctuations in the market. External auditors do an annual audit of the company’s financial statements to make sure the financial requirements are met.

XM is thus counted as a regulated and safe broker to invest your funds with. One can rest assured as the top regulators and external auditors both keep an eye on the company and its statements.

XM Trading Fees

There are mainly five types of fees that XM charges to its clients in different cases:

1. Spread: XM charges the lower average/typical spread when compared to the other brokers.

For example, for an account type like Ultra Low Standard Account, for a major currency pair like EURUSD, the typical spread/fees charged on a Premium account is 0.8 pips per standard lot. If we compare the same currency pair of EURUSD with Hotforex, they charge 1.2 pips per standard lot with their similar “Premium account”.

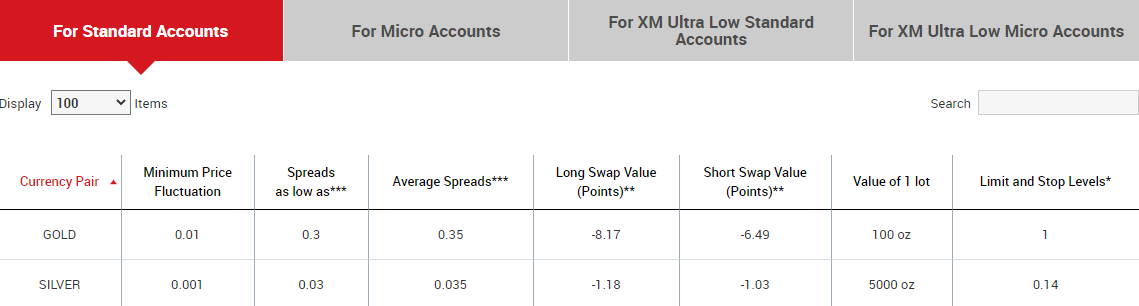

Below table from their website shows their average ‘Gold CFD’ spread with their Standard Account.

2. Commissions: There are no commissions charged by XM broker with any accounts, as they are a spread-only broker.

3. Rollover: A rollover fee is typically charged by all the brokers. It is basically the interest charged or earned for holding positions overnight (i.e. open positions). It is calculated based on the difference of interest rates of the two traded currencies. Buying a currency with a higher interest rate and selling the lower interest rate currency would typically earn you rollover fees.

4. Deposit/Withdrawal fees: There is no withdrawal or deposit fee with XM.

5. Inactivity: XM charges an inactivity fee if the account is untouched for more than six months. Inactivity would mean that there is no deposit, no withdrawal, no trading, no internal transfers, and no additional trading accounts. All credits and benefits would be removed from the dormant accounts. A monthly fee of $5 will be levied every month. The fees would be deducted from the free balance available in the account. If there is no free balance then no fee would be levied.

Looking at the fee structure in detail under the five points above, XM’s overall trading fees are quite competitive & fair.

But, if you are a high-volume trader (more than 10 Standard Lots per month) then Hotforex’s Zero account fees would be lower comparatively.

Account Types at XM

XM provides three types of accounts apart from a Demo account.

The Demo account is a trial account with dummy money that can be created and used for practicing one’s trading strategies and understanding. There are many advantages of the Demo accounts. These are just like live accounts with real market pricing, unlimited usage, access to the MT4 & MT5 terminal, and Webtrader platforms.

Demo Account Registration is easy & quick at XM. It can be done online by providing personal and trading account details. Up to five demo accounts can be opened by one user.

Live Accounts:

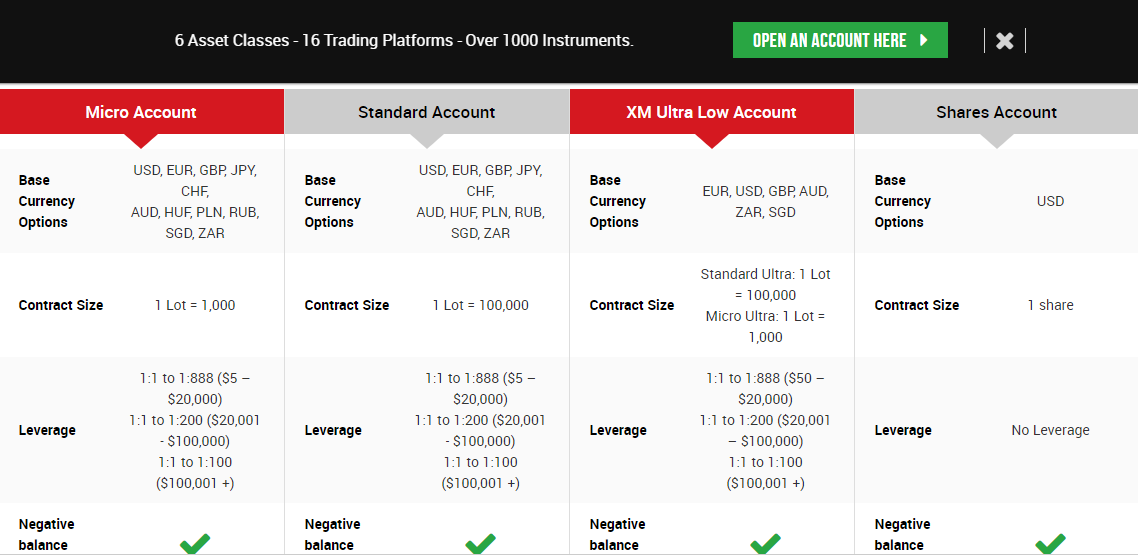

Now let us look at three live account types, Micro, Standard, and Ultra-Low accounts for a benchmark currency pair of EUR/USD. All the accounts have negative balance protection.

Let’s take a look at the 3 Live accounts available at XM:

Micro Account has a minimum deposit requirement of US$5 and the leverage varies depending on the deposit amounts. For deposit amounts of US$5 to US$20,000, the maximum leverage provided is 1:888. Similarly, for deposit amounts of US$20,001 to US$100,000, the maximum leverages provided are 1:200 and 1:100 respectively. The spread is as low as 1.6 pips per standard lot for EUR/USD. There is no commission charged in this account.

For Standard Account, the deposit and maximum leverage provided are the same as that of the Micro Account. The lowest spread also remains the same, 1.6 per standard lot, for EUR/USD pair. This account too has no commission charges.

Ultra-Low Account requires a minimum deposit of $50, leverage remains the same as that provided on micro and standard accounts. The lowest spread of 0.6 pips on the EUR/USD pair is charged.

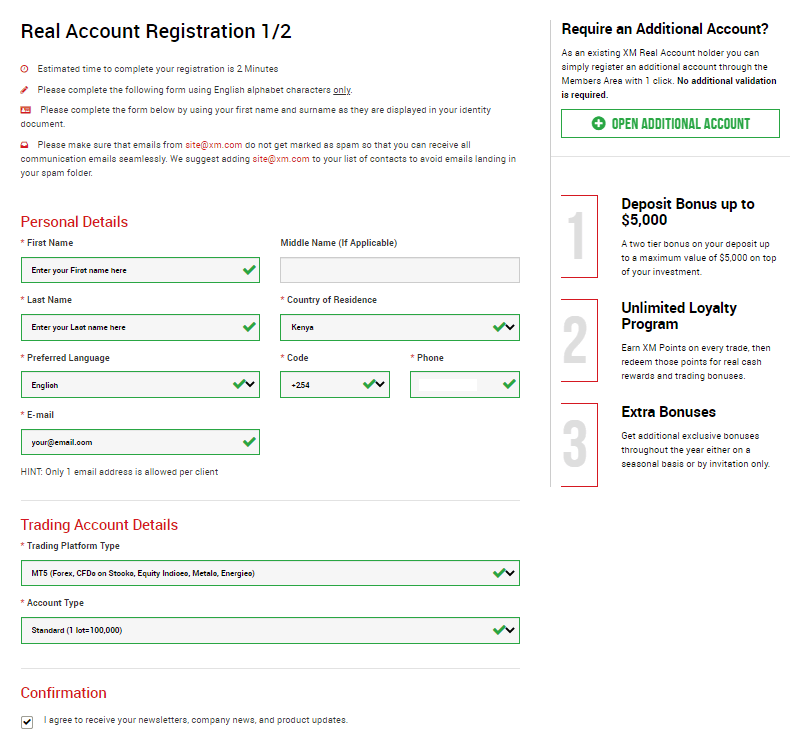

How to open account with XM?

Step 1) Click on OPEN AN ACCOUNT: First of all, you need to click on OPEN AN ACCOUNT button at the top of the home page of the XM broker’s website.

Step 2) Enter Personal Details: Now you need to enter some personal details and also select the trading account types as shown in the below screenshot.

Step 3) Set Trading Account Password: Enter the password that you want to set. You need to enter the strong password which inclide charcter, number and sybols.

Step 4) Account Verification: After setting the account password, you need to verify your account details which is the part of KYC. You need to upload your valid ID proof and Address proof.

Step 5) Fund your account: At last, you need to add the funds to your account for start trading. You can fund the account using any of your preferred payment method.

Trading Instruments at XM

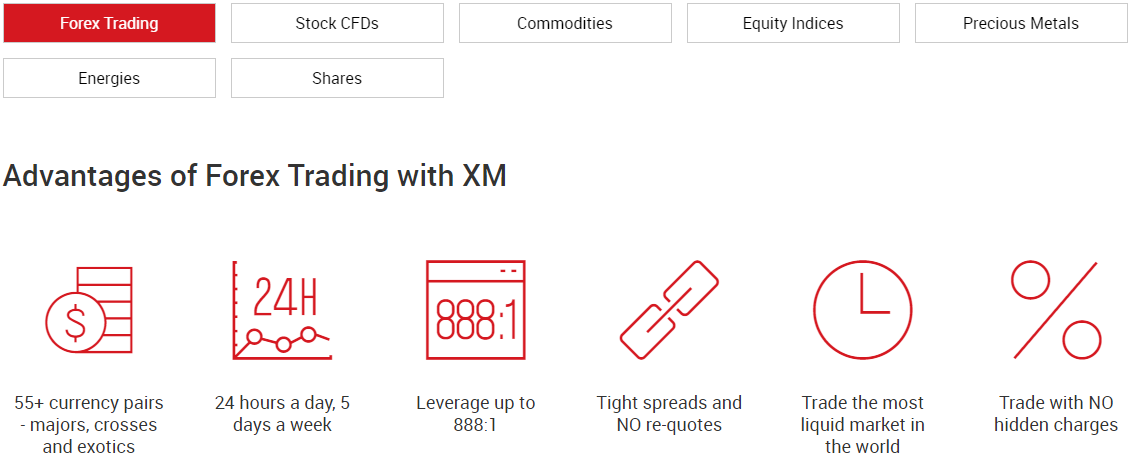

There are a variety of trading instruments offered by XM for your trading needs. Let us look at them in detail:

Forex Trading currency pairs: Forex is one of the most traded instruments at XM & they have a total of 57 forex pairs to trade, with some of the lowest spreads in the market. XM offers access to real-time pricing for the forex market.

Stock CFDs: There are a number of stocks on which CFDs are available in XM to trade from. These Stock CFDs are classified as per region and the description of the stocks is given along with the symbol of the stock.

There are around 1150 Stock CFDs listed for trading across different regions. Stock CFDs at XM are available have no extra cost other than the normal trading spread, & can be accessed for global markets, both long and short trading strategies can be used, with speculations that can be done on upward and downward movements. Another advantage of using Stock CFDs is that you get instant access to global economies and can go long or short according to your market bias.

Commodities: Commodity trading can also be done on XM by trading them as Future CFDs. The commodities available for trading are cocoa, coffee, corn, cotton, copper, soybean, sugar, wheat.

Equity Indices: XM provides a wide range of top global indices to trade from in form of Cash CFDs and Futures CFDs. There are 18 Cash Indices and 12 Futures Indices on offer for trading in Indices at XM. As and when, these cash and future indices receive dividends, that will be given to the clients.

XM has clearly explained what are Cash and Futures Indices dividends and how they are calculated. So traders who want to trade them can refer to the indices instruments on their website.

Precious Metals: Under Spot Metal trading, XM provides trading on Gold and Silver. For other precious metals like Platinum and Palladium, trading is offered through Future CFDs.

Energies: For energies trading, Future CFDs on a variety of Oil and Gas instruments are listed on XM. An overview of energies is given on XM’s website along with the general calculation of margin requirement.

Shares: XM doesn’t fall short here either as they provide trading in the Equities market, with the option to trade on shares of top global companies. There are 100 company shares available with XM. As a broker, they have included the symbol and ISIN (International Securities Identification Number), too, on which the particular stock is listed. This information is quite helpful while trading.

XM offers Metatrader Platforms

XM provides its clients with trading access on standard MT4 and MT5 platforms.

Both the platforms have the provision of access from desktop terminal, web terminal and on Android and iOS devices. Apart from that, MT4 Multiterminal provides access to multiple accounts simultaneously.

Overall, their trading platforms are quite standard of a Metatrader broker.

Do we Recommend XM Broker?

Yes, we do recommend XM broker for traders in Kenya because of the fact that XM is a reputed forex broker.

XM has been in the market since 2009 and still continues to have a considerable share in the retail forex trading market globally in terms of daily volume.

We recommend them as they are regulated by top regulators ASIC & CySEC. They have demo accounts, no commissions, low spreads, easy deposit & withdrawal methods, and flexible leverage settings.

Apart from all this, they provide education and research too. One can research markets, news, technical summaries, technical analysis, trade ideas. Also, there are videos and an economic calendar, as a plus point.

XM also has quite a lot of resources for educating its customers. These include: Live Education, Educational videos, Forex webinars, Platform tutorials, and Forex seminars make a long list of trading essentials.

Five demo accounts per client is a good offer for the new traders to start trading on a demo environment and test their real strategies & learn the market fluctuations. The number of trading instruments available is also wide.

Their promotional offers are also exciting. There is a welcome bonus, 10th-year anniversary-lucky draw, XM loyalty program, free services, and zero fees on deposits and withdrawals.

Their support is also quite good, and we found their chat to be extremely friendly & helpful without much hold time.

Although the cons are that: they don’t have a Kenyan phone number for support.

Also, they are not regulated by CMA, and they charge inactivity fees if you don’t access your account for a while. And they are a market maker broker without any ECN account, so you may not get the lowest fees with very high trading volumes.

Though, leaving these cons aside, XM stands out and has been around for quite some time, so can be considered safe for trading.

XM Forex Broker FAQs

What is the minimum deposit at XM broker?

Is XM a legit forex broker?

What are the withdrawal methods available at XM?

XM Forex Kenya