Pepperstone Kenya Review 2023

Pepperstone is one of the four CMA regulated STP forex broker in Kenya. It offers lowest spreads on major currency pairs. Pepperstone has a local office in Nairobi and offers local phone support. Read our honest and unbiased review of Pepperstone Kenya before opening your trading account.

Pepperstone is a well-regulated STP broker based in the Bahamas. It is a CMA (Kenya) regulated broker that allows trading through multiple trading platforms on a decent number of trading instruments.

We liked the low trading fees at Pepperstone. Their fees is low with their Razor account, which has Raw spreads from 0 pips & commission of $8/lot.

Multiple regulatory licenses in various jurisdictions around the globe & regulated with CMA makes Pepperstone a low-risk forex and CFD broker. The broker accepts multiple transaction methods from traders in Kenya.

The availability of a local office in Nairobi along with local phone support is a pro for Kenyan forex and CFD traders.

Read our unbiased & comprehensive review of Pepperstone Kenya based on their regulations, fees, platforms & other factors. We have reviewed every aspect of PepperStone that you must understand before choosing them.

Pepperstone Kenya Pros

- Pepperstone is regulated by CMA, FCA, ASIC, CySEC, etc.

- It has a local office in Nairobi, Kenya.

- The spreads are low starting from 0 pips.

- Local phone support in Kenya.

- MT4, MT5, as well as cTrader trading platforms available on all devices.

Pepperstone Kenya Cons

- No bonus offerings.

- Shilling-based account type not available.

- Not listed on any stock exchange.

Pepperstone Kenya – A quick look

| 👌 Our verdict on Pepperstone | #1 Forex Broker in Kenya |

| 🏦 Broker Name | Pepperstone Markets Kenya Limited |

| 💵 Typical EURUSD Spread | 1.1 pips (with standard MT4 Account) |

| 📅 Year Founded | 2010 |

| 🌐 Website | www.pepperstone.com |

| 💰 Pepperstone Minimum Deposit | 200$ |

| ⚙️ Maximum Leverage | 1:400 |

| ⚖️ Pepperstone Regulation | CMA, CySEC, FCA, ASIC |

| 🛍️ Trading Instruments | 61 currency pairs, 100+ CFDs on Indices, Cryptos, Metals, etc |

| 📱 Trading Platforms | MT4, MT5, & cTrader for desktop, web & mobile |

| 📒 Demo Account | Yes |

| 💰 KES Base Currency | No |

Is Pepperstone Safe?

Before putting your hard-earned money at the risk of capital markets, it is important to ensure that the chosen broker is safe and secure. Regulatory authorities ensure the safety of traders and overlook the activities of the licensed brokers to prevent cons and scams in the capital markets.

Following regulatory authorities have granted regulatory licenses to Pepperstone.

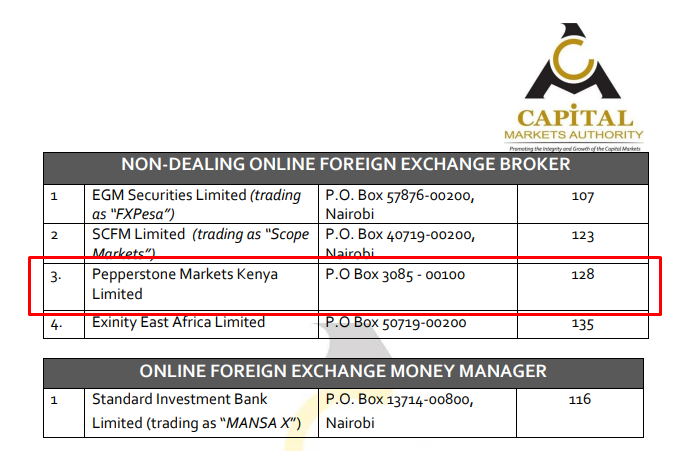

- CMA: Pepperstone is regulated as Pepperstone Markets Kenya Limited by Capital Markets Authority (CMA) in Kenya under license number 128. For any of the forex and CFD broker to offer services in Kenya, it is essential to acquire CMA regulatory license. CMA has only authorized 4 non-dealing forex brokers to offer online trading services on Forex and CFD instruments in Kenya and Pepperstone is one of them.

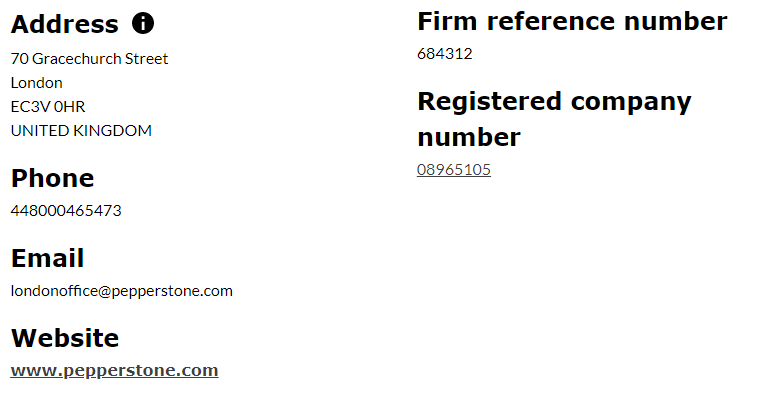

The CMA regulation in Kenya allows Pepperstone to offer a maximum leverage of 1:400 with no negative balance protection for Kenyan clients. CMA is not a top-tier regulatory authority and has lesser strict compliance guidelines. Although CMA regulation makes Pepperstone safe for traders in Kenya. - FCA: Pepperstone Limited is regulated by Financial Conduct Authority (FCA) under license number 684312. FCA is a top-tier regulatory authority based in the jurisdiction of the United Kingdom (UK).

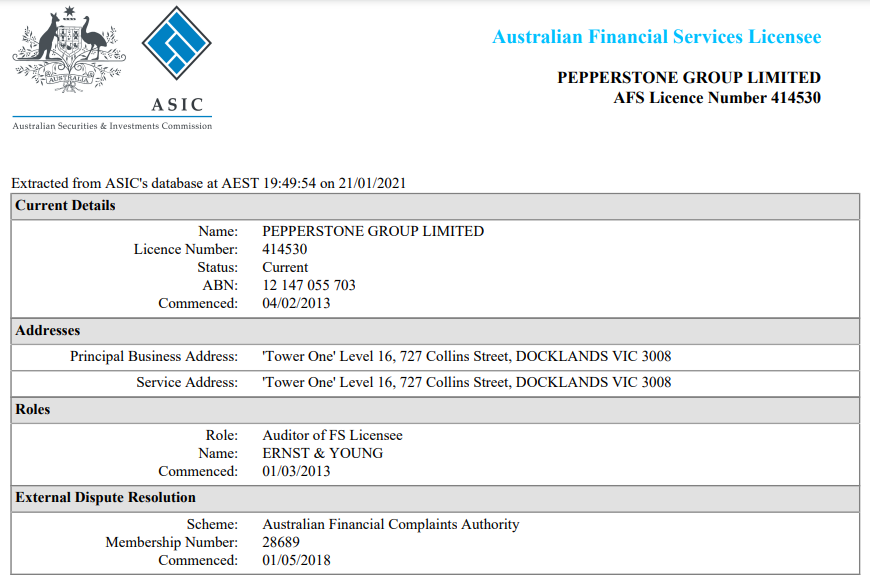

- ASIC: Pepperstone Group Limited is regulated by the Australian Securities and Investment Commission (ASIC) under license number 414530.

- CySEC: Pepperstone is regulated by Cyprus Securities and Exchange Commission (CySEC) under license number 388/20. CySEC regulation allows Pepperstone to offer online trading services in European Union.

Pepperstone is regulated by several other financial regulatory authorities like DFSA, SCB, and BaFin. However, for traders in Kenya, Pepperstone complies with CMA regulation as a non-dealing desk online foreign exchange broker.

Pepperstone was launched in 2010 and is not publicly listed. The broker does not have a parent bank or banking license and the funds are kept in segregated bank accounts.

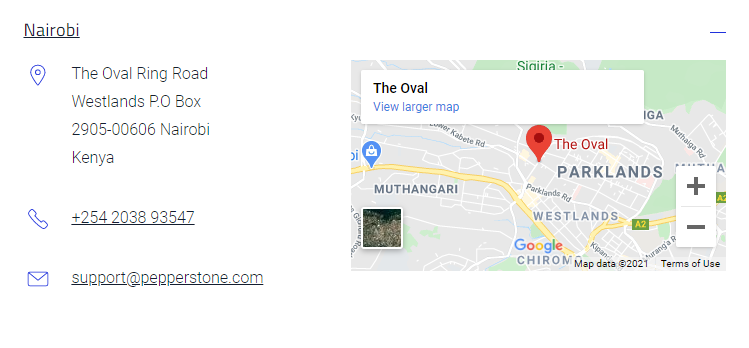

It has a local office in Nairobi which further enhances the safety ratings of Pepperstone in Kenya. We couldn’t find any major registered case for scams or deceit against Pepperstone.

Due to its CMA regulation along with multiple other top-tier regulatory licenses, we found Pepperstone to be one of the safest forex and CFD brokers in Kenya.

Pepperstone Fees

Pepperstone charges much lower trading and non-trading fees from traders in Kenya. The entire fee structure has been reviewed separately for trading and non-trading fees.

Trading Fees

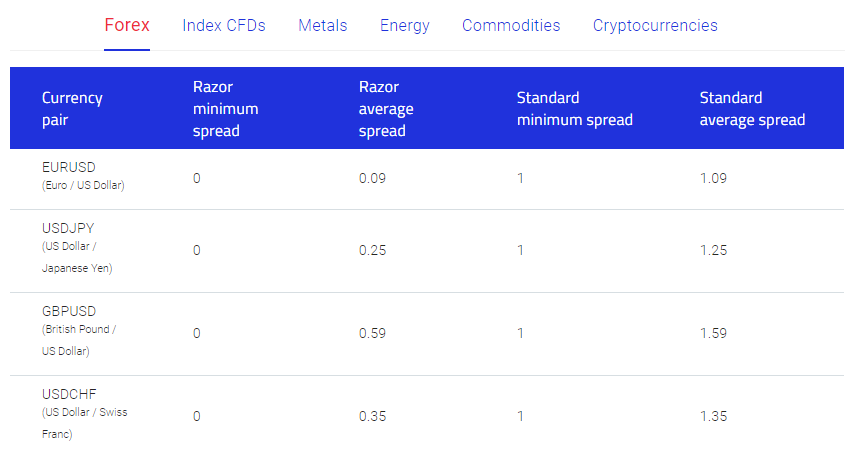

This comprises spreads and commission, i.e. the fees charged while opening or closing the trade orders. The spreads and commission are incurred differently depending on the account type chosen by the trader.

- Trading Fees on Standard Account

The standard account does not involve any commission as the spread is the only constituent of trading fees. The spreads are variable and change depending on liquidity in the market and other conditions. Spreads on currency pairs with the standard account start from 1 pips per lot. Spreads on commodities and indices start from 0.05 and 0.4 pips per lot.For EUR/USD, the average typical spread was found to be 1.0 – 1.3 pips per lot with the standard account.

- Trading Fees on Razor Account

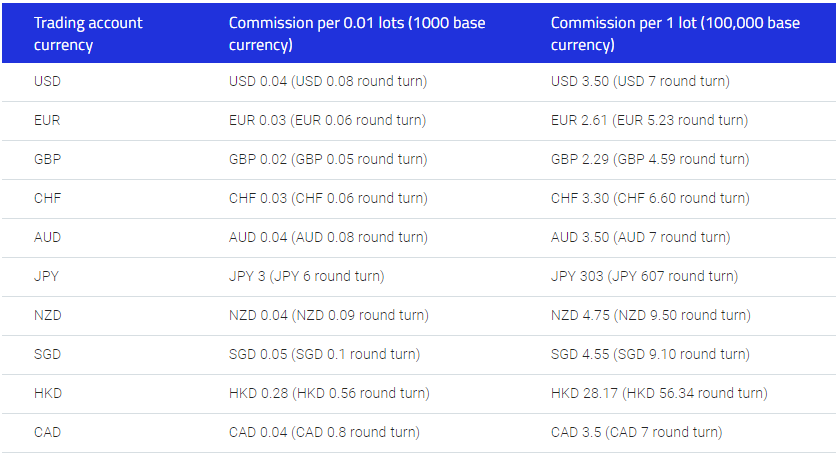

The spreads on the razor account are also variable but are much lower than the standard account. Additionally, Pepperstone charges a commission for each trade depending on the base currency chosen by the trader. The commission is only applicable on forex trading with the razor account. For all the other trading instruments, the spread is the same for both account types with no commission involved.

For USD-based accounts, the commission for each round trade is 7 USD and 7.53 USD per standard lot for MT5 and MT4 trading platforms respectively. With the cTrader trading platform, the commission remains 7 USD for a round trade of standard lot regardless of the base currency.

The average typical spread for the EUR/USD currency pair was found to be 0.0 – 0.3 pips per lot.

Compared to all the CMA-regulated forex brokers in Kenya, the trading fees are lowest at Pepperstone. The low trading cost makes it the most cost-effective regulated forex and CFD broker in Kenya.

Non Trading Fees

We found Pepperstone to be very attractive in terms of non-trading fees compared to all the available forex brokers in Kenya.

1) Inactivity Fees: Pepperstone does not charge any account opening & inactivity fees from their traders.

2) Currency Conversion Fee: No currency conversion fee is charged even if the deposit currency is different from the base currency of the account.

3) Deposit & Withdrawal fee: The deposits and withdrawals are free for most of the methods but some of the transaction methods can incur additional cost.

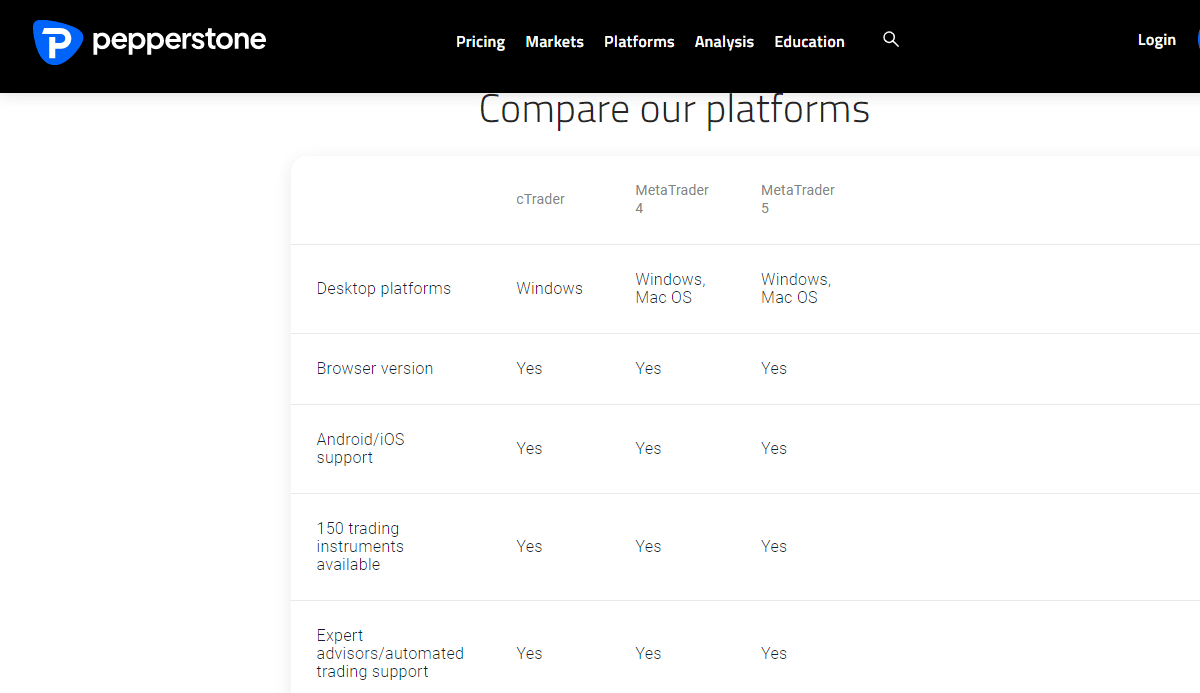

Trading Platform

Pepperstone allows the traders to choose from 3 of the most widely used trading platform for forex and CFD trading. Pepperstone supports the complete suite of most popular MetaTrader trading platforms for various devices.

1) MT4 & MT5: The MetaTrader 4 and MetaTrader 5 are available for web, Windows, macOS, Android, and iOS devices.

2) cTrader: Apart from this, Pepperstone also offers the cTrader trading platform which is also a widely used trading platform for online forex and CFD trading. The trading platforms at Pepperstone are user-friendly and can be customized according to requirements.

We found Pepperstone to be very impressive for clients in terms of trading platforms. The availability of multiple trading platforms serves the suitability of different types of traders.

Customer Support

Traders in Kenya can reach out to the customer support executives at Pepperstone using multiple methods. We tried to connect with them multiple times through different methods and the following was our experience:

- Slow Live Chat: The English live chat at PepperStone Kenya is available 24/5. Our experience of customer service via live chat was decent during our tests as we received a relevant and helpful reply for every query. Although, the response & hold time of the support executives ranged from 5 to 10 minutes depending on the rush at the time the query is raised.

- Decent Email Support: You can also contact PepperStone by sending an email to [email protected]. They reverted back on the same day during our tests, but we found it to be slower than other brokers like FxPesa.

- Kenyan Phone Support: Pepperstone has a local office in Nairobi. Traders in Kenya can reach out to the support staff at Nairobi through a local phone number (1300 033 375). This is the best means for Kenyan traders to connect with the customer support staff and get quality assistance.

The live chat feature is helpful to resolve a query but, a longer waiting queue makes it a decent choice to connect with Pepperstone. The availability of a local phone number along with a local office is a major advantage of choosing Pepperstone in Kenya.

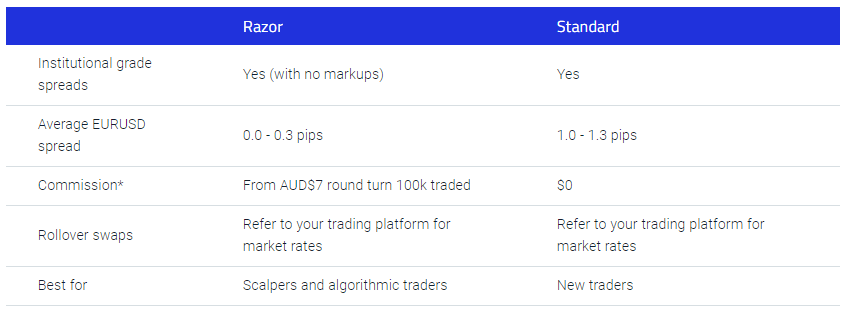

Account Types

Pepperstone offers 2 live account types namely standard and razor accounts. There is no major difference in the features available with the two account types as they only differ on the basis of trading fees.

- Standard Account: It is a commission-free account type that incurs a higher spread on currency pairs compared to the Razor account type.

- Razor Account: It offers institutional grade spreads starting from 0 pips but involves a commission on currency pairs. The commission of the razor account differs depending on the trading platform chosen by the trader.

The number of available instruments, maximum leverage ratios, base currency, trading platforms, etc is the same for both account types. The trading fees for all the other instruments except forex pairs are also the same for standard and razor account.

Traders in Kenya can open any of the account types with a minimum deposit of 200$ with the base currency of USD, EUR, and GBP. Traders must note that Pepperstone does not offer a Shilling based trading account and traders must choose between USD, EUR, or GBP. Although, deposits made through shilling won’t be liable to any currency conversion fees on the broker’s side.

According to our review, the standard account is ideal for beginner traders and low volume traders while the razor account can serve well for the experienced and high volume traders due to low spreads.

We liked both the account types at Pepperstone as they offer similar features except trading fees. The minimum deposit requirement is slightly higher while the unavailability of Kenyan Shilling (KES) base currency trading account is a drawback. Availability of all the trading instruments on both the account type is advantageous for the traders.

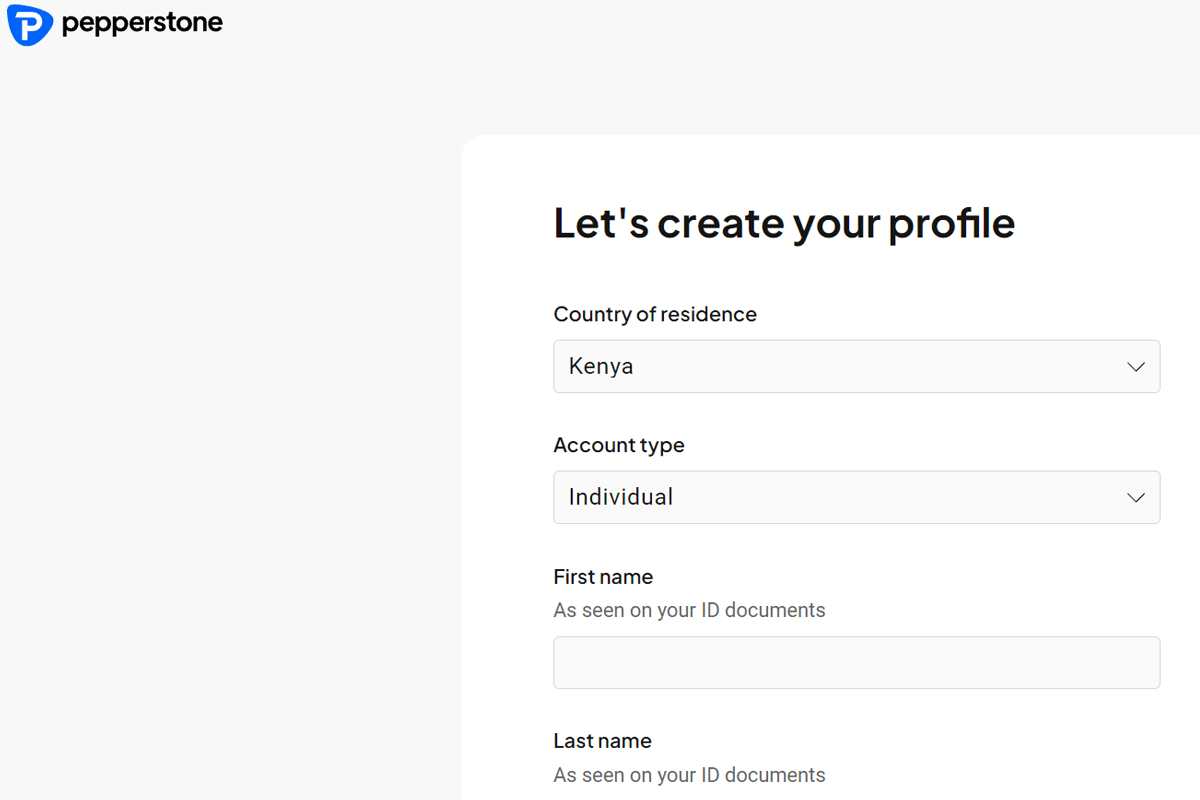

How to open account with Pepperstone

Opening a trading account with Pepperstone require only 1-2 minutes. You can follow the below steps to open account with Pepperstone:

Step 1) First of all you need to visit the homepage of Pepperstone Kenya and click on Join Now button.

Step 2) Now to you need to create your profile by entering your basic details as shown in the below screenshot.

Step 3) After setting password, you need to verify your account by submitting your 1 ID proof and 1 Address proof.

Step 4) Once your account is verified, you need to login to your account and make a deposit in your account for start trading.

Available Instruments

The number of available trading instruments at Pepperstone is decent. However, when compared to other regulated brokers in Kenya, the numbers are impressive. More available instruments provide more opportunities for traders to book profits.

Following trading, instruments are available at Pepperstone for traders in Kenya.

- Forex: Pepperstone offers trading on a total of 61 currency pairs including 6 major, 9 minor, and 46 exotic pairs. The maximum available leverage on currency pairs is 1:500.

- Index CFD: A total of 14 CFDs on major indices of the world are available to trade at Pepperstone with a maximum leverage ratio of 1:200.

- Share CFD: Traders can trade with more than 60 major stocks traded on NASDAQ through CFDs without actually owning the shares. The maximum available leverage ratio on stock CFDs is 1:20.

- Commodities CFD: prices of more than 22 commodities can be speculated without owning them through CFDs with a maximum leverage ratio of 1:500. The CFDs on commodities include coffee, cocoa, sugar, gold, silver, palladium, crude oil, etc.

- Cryptocurrency CFDs: A total of 9 CFDs on different cryptocurrencies can be traded at Pepperstone with a maximum leverage ratio of 1:20.

Overall, the number of the available trading instrument is higher than many of the forex and CFD brokers in Kenya. Traders can choose the most suitable market to trade according to their suitability.

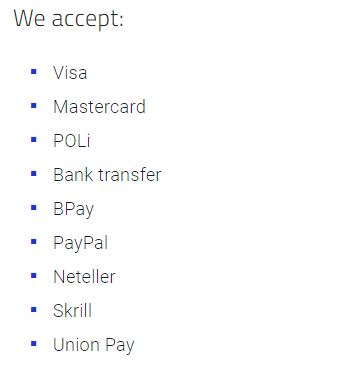

Deposits and Withdrawals at PepperStone Kenya

Pepperstone supports multiple means to transact for traders in Kenya. Apart from local bank deposits and withdrawals, traders can use credit/debit cards and various e-wallets as well to deposit and withdraw.

Pepperstone does not charge any additional commission for deposits and withdrawals but traders might need to pay commission to a third-party payment gateway. Any transaction request made before 21:00 GMT or 12:00 AM EAT (East African Time) will be processed on the same day. Any order after this time will be processed on the next business day.

Any commission incurred by the third-party payment gateway like International Telegraphic Transfer fees or e-wallet commission needs to be paid by the clients. Bank transfers are not an ideal choice for traders in Kenya as it may take 3-5 business days to process the transaction.

A wide range of payment gateways and no additional commission make deposits and withdrawals easy for traders in Kenya. Pepperstone does not accept deposits or withdrawals through cryptocurrencies.

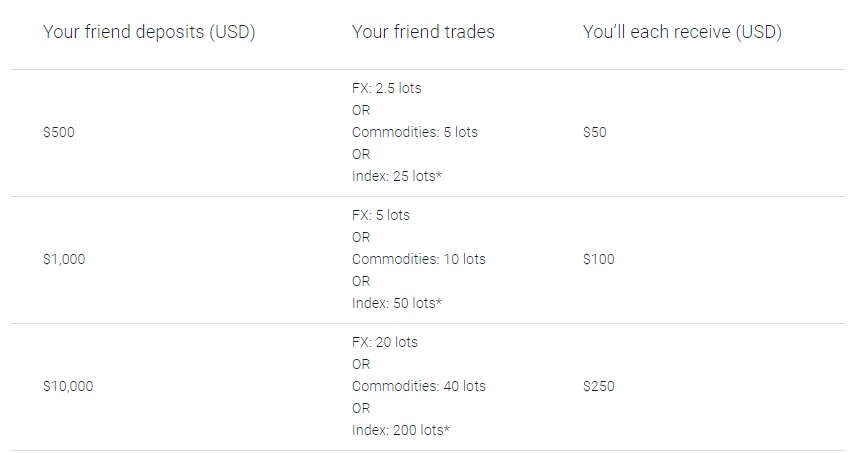

Pepperstone Kenya Bonus

We couldn’t find any deposit bonus, account opening bonus, or rewarding competition for the traders in Nigeria. It does have a referral program in which traders can get up to a maximum of 250$ if the referred client makes a deposit of $10,000.

Unlike many of the forex brokers, Pepperstone does not have any bonus offerings for the traders in Kenya. The broker aims to offer quality trading service at a low cost and does not seek to lure clients with short-term attractive offerings.

Do We Recommend Pepperstone Kenya?

Apart from CMA, Pepperstone is regulated by multiple Tier 1 & Tier 2 regulatory authorities like FCA, ASIC, and CySEC. This makes PepperStone a very safe CFD broker for forex traders based in Kenya.

The trading as well as non-trading fees with their Standard Account are lower than other CMA-regulated brokers in Kenya, but their overall fees with Razor account is about the same as FxPesa’s Premiere account & Scope market’s Gold Account. Availability of local office in Nairobi, local phone support, multiple trading platforms makes PepperStone a good choice for forex traders in Kenya.

Pepperstone Kenya FAQs

What is the minimum deposit amount for Pepperstone?

There is no minimum deposit requirements, but the recommended minimum deposit by them for all trading account with Pepperstone is $200. Pepperstone does not offer Kes. as base currency for trading accounts. So all traders need to make a deposit in USD.

Is Pepperstone a good and regulated broker?

Yes. Pepperstone is regulated with local regulator CMA (Capital Markets Authority) and with FCA in UK. As Pepperstone is regulated locally in Kenya & with Tier-1 regulations, so your funds and trading with them is considered safe. They are a low-risk broker for forex trading.

How can I withdraw money from Pepperstone?

You can submit the withdrawal request from your Pepperstone client area. After you have logged in to your account, you need to navigate Funds and then click on Withdraw Funds & then follow the withdrawal confirmation mail on registered email. You can withdraw via local methods like MPesa, and there is no extra fees with it.

PepperStone Kenya Kenya