If you are trading forex, then you will come across some terms that you should remember if you want to be an active trader.

In this chapter, we will cover important terms like Currency Pairs, Pips, Leverage, Spread etc.

Let's go.

See our list of best rated forex brokers that are available to traders who are trading from Kenya. We opened trading accounts with these forex platforms to check their a/c charges, opening process for traders, cost of trading. We've published our complete research on forex brokers in Kenya if you need to know more.

| Forex Broker | Highlights | Average Fees (EURUSD) | Account Minimum | Current Offers | Learn More |

|---|---|---|---|---|---|

|

Parent company EGM Securities is licensed by CMA. Trade 66 currency pairs & 100+ CFDs on shares, commodities. |

Fees (EURUSD)

0 pips

lowest spread |

Account Minimum

$5 (Ksh. 508)

|

Current Offers

30% Bonus

For all new client on first deposit (minimum deposit amount to be eligible is $100) |

Visit FXPesa Read FXPesa Review | |

|

Regulated with FCA. FxPro is not a CMA regulated broker. |

Fees (EURUSD)

0.3 pips

lowest spread with cTrader + $0.35 commission per 10,000 units per side |

Account Minimum

Ksh. 1500 (you can also deposit with MPesa)

|

Current Offers

NA

|

Visit FxPro | |

|

EUR/USD Spread from 1.3 pips with Premium Account & 0.1 pips + $6/lot with Zero Account. Regulated with CMA. |

Fees (EURUSD)

0.1 pips

(plus $6 per lot) with Zero Account |

Account Minimum

$5

|

Current Offers

50%

Welcome Bonus |

Visit HotForex Read HotForex Review |

In this step-by-step guide we wil explain everything you need to know about Online Foreign Exchange trading in Kenya as a beginner trader.

It should take around 30-45 minutes to fully read this guide. You can also use the link above to download this guide if you are short on time & want to read it later.

Forex trading is trading in different currency pairs with the aim to earn profit from the difference in the value of the currency pair due to market movements.

For example, let’s take the currency pair of Kenyan Shilling (KES) and US Dollars (USD). 1 USD is equal to 100 KES. KES is a not a strong currency like USD. Hence if we buy 5000 USD then we have to pay 500,000 KES. Now suppose the value of KES increases in the market. In that case, we have to pay less KES for every USD bought. That would also mean that for every USD you sell, you would receive more KES than you paid. This difference between the KES paid and received is the profit that you earn.

Forex trading is a profitable only if you know how to study the currency pairs and when to invest in which currency pair.

Forex Market is the most Liquid market in the world & has the highest daily traded volume globally, higher than any other market or exchange. The daily volume of Foreign Exchange Market was around $6.6 Trillion in 2019, according to research by BIS.

By trading in the forex market, you can exchange one currency for the other.

Let's say you have 20 US Dollars, but you want Kenyan Shillings instead. Then you can convert your US Dollar into Ksh. via a regulated exchanger or bank. They will convert your Dollar into Kenyan Shilling at the latest exchange rates.

In this above example, the exchange or bank will also charge a markup fees, to process your forex transaction. This fees is generally by offering you a sell rate higher than the buy rate. Let's say buy rate for 1 USD would be 106 Ksh. then the sell rate would be 105 or lower, depending on your bank which is participating in the FX market on your behalf to exchange your currency.

If you are trading forex, then you will come across some terms that you should remember if you want to be an active trader.

In this chapter, we will cover important terms like Currency Pairs, Pips, Leverage, Spread etc.

Let's go.

In the forex market all currencies are traded in pairs, against each other. Eg: Euro against the US Dollar, would be EUR/USD.

This essentially refers as what is the value of Euro against 1 US Dollar.

There are 3 currency pair types: The Majors, Minors & Exotic currency pairs.

Below is a breakdown of the Currency Pair types.

Pip is the smallest decimal value in a currency's price. It is generally the last decimal in the quote.

Example: In case of EUR/USD let's say the value is 1.2101, then the last decimal value in it is the pip. The movement from 1.2101 to 1.2102 is referred to as 1 pip.

Leverage allows the investors/traders to gain exposure in the financial markets with a smaller upfront capital known as margin. This is effective because it leaves the extra money with the investor with which other investment options can be tried or can be kept for personal use. Leverage is given by CFD brokers.

For example, let’s take a trade scenario for EUR/USD pair, where we are buying EUR at 1.0840 (1 EUR = 1.0840 USD) by spending USD. Since forex trades generally take place in standard lots, which is 100,000 units of currency, we assume we are buying 1 lot of EUR.

Since any trade would require margin, let us assume the required margin is 2% of the trade value (which is 1.0840 * 100000 = $108,400). That would put the margin at $2168. Leverage is calculated by dividing the total trade value by the margin required. This would give us a leverage of 50:1. In case the EUR value appreciates by 100 pips to 1.0940, closing the trade by selling the bought EUR would give us a profit of $1000. With 50:1 leverage, our return on capital is 46%. However, if a broker provides a higher leverage of, say, 100:1, our margin requirement then would be as low as $1084. With the 100 pips appreciation in the market, we still make $1000 profit but now our return on capital would be 92%.

Hence, we are able to trade and profit more with less capital but high leverage. Most investors look for high leverage offerings but one should understand that high leverage also increases the risks of high losses in case of negative trades.

Note: Leveraged forex trading is risky & hence you should not use more than 1:10 leverage. CMA regulated forex brokes offer as high as 1:400 leverage on forex, but you must self-regulate & not trade with more than 1:10 leverage on any trade. For CFD instruments other than forex, you should strictly use leverage of no more than 1:5.

Also Read: Our guide on What is Leverage in Forex Trading

The bid price is the maximum price at which a trader or a broker is willing to buy a forex pair. The ask price is the minimum price at which a trader or broker is willing to sell a forex pair.

One thing to note here is, the bid and ask prices operate differently for brokers (or market-makers) and price takers (or regular investors). Market-makers buy at the bid price and sell at the ask price. Price takers buy at the ask price and sell at the bid price.

The concept of the bid and ask prices is similar to the buying and selling prices of groceries from the perspective of a shopkeeper. As a shopkeeper, the wholesaler's selling price is equal to your buying price. Similarly, when you are selling the same groceries to your customers, your selling price will be equal to your customers' buying prices.

Generally, the bid prices are lower than the respective ask prices. This is because the sellers try their best to make a profit off a trade.

The difference between the bid price & the ask price is the forex broker's spread. It is good for you if your broker has a lower spread, which would mean lower fees for a trade.

For trading in the forex market you need to trade via a broker. Forex & CFD Brokers charge fees by means of spread, which is the difference between the buying & the selling prices

Like the above "Real Life Forex Example" brokers too charge the difference in buying & selling prices of a currency pair. Eg: Let's say you want to place a Long order on EUR/USD, means buying Euro against the US Dollar. The broker's Bid price would be quoted as something like 1.2102, and the Ask price could be 1.2104. The difference between this is the broker's fees called the spread.

The lower the spread, the better it is for trader. This is because it will allow you to retain more profit (or a lower loss).

But you must also consider if the broker has other charges too, like commissions, withdrawal/deposit fees etc. as these can make the overall fees higher even if the spread is low.

For ex. Consider a case where Broker A has a spread of 1 pip for a trade on EUR/USD, but their deposit/withdrawal charges are 2% of the amount, then this is an extra charge that you have to pay on the complete amount. And there is Broker B, that has 1.2 pips spread on a EUR/USD trade, but there are no other commissions. The overall fees would likely be lower with broker B, depending on your trading volume.

The value of your order will depend on the units of a currency traded. Generally these units are referred to as lots. Say, you are buying $100,000 worth something, then this refers to 100,000 units.

There are 3 Lot Sizes:

You will see the option to choose the number of lots that you want to trade on the brokers platform. Most brokers allow to trade custom number of lots, for example you can trade 5 Mini Lots, or even 5.2 Micro lots. Brokers like FxPesa, Exness etc. that offer MetaTrader have this option.

Account currency is the currency in which you have opened your trading account & also hold your balance in that unit of currency. For example, if you have opened your account in KSh. then all your trading funds i.e. your account balance, trading P&L etc. will show in KSh..

Kenyan traders have the option to choose between KES (Kenyan Shilling) or USD (US Dollar), as your account currency.

Whatever currency you choose, on your broker's platform you will see that as the default.

For example, see the below screenshot from a broker's MT4 platform (demo). The account equity is in USD. Your 'account history' will also be in this currency.

Note that it is important to choose the right account currency based on which instruments you trade the most. This is because most brokers charge account currency conversion charges. These apply when they convert your profit & loss in your account's native currency.

Let us understand this with an example: assume that you have Kenyan Shillings (KES) as your account currency, and you make a profit of $10 from a EUR/USD trade. We will also assume that the broker charges a 2% conversion fee when converting from USD to KES, because 2-5% is common & we are using the lowe limit.

Realized Profit After conversion charges will be USD 10 - 2% of your Profit (loss). This comes out to be 9.90 USD (10 - 0.1).

Assuming that the USD to KES rate is 125 (and if your broker does not charge any markup on this), then you will have made 1237.5 KES, instead of 1250 KES.

This might not seem like a big amount initially, but the more actively you trade, the more this could add up against you. And you also have to remember that this conversion happens even during losses, and the charge applies there as well, negatively.

You need to start by choosing a regulated broker & open account with that broker. Capital Markets Authority (CMA) of Kenya has made online forex trading in Kenya more regulated now. Trading with a licensed broker with ensure that your funds are protected & you can get compensation of upto Kes. 50,000 in case the broker goes out of business.

To trade forex in Kenya via a locally regulated broker, you need to open an account with any of the forex brokers regulated and licensed by CMA. There are six such brokers who are regulated by CMA: EGM Securities, PepperStone Kenya, ForexTime (Exinity Group), HotForex, Windsor Markets and Scope Markets.

There are also global foreign regulated forex brokers accepting traders from Kenya - that are regulated with foreign regulators like Financial Conduct Authority (FCA), Financial Sector Conduct Authority (FSCA), Australian Securities and Investments Commission (ASIC) and the likes.

It is recommended that you choose the only brokers that are licensed by CMA. Only this will ensure that you are trading forex legally.

Most brokers now have low deposit requirements of as low as $5 to open Live trading account & start trading. As an example, HotForex has $5 deposit with their Micro Account.

Almost all the brokers provide demo accounts. Demo accounts are like real trading accounts, and your can trade and understand the nuances of trade just like real trading account without risking your real money. Your demo account will have dummy funds, and you can use them to test out your strategies & learn under real market like conditions.

Note: The market & trading conditions with a broker's demo account platform would likely not be the same as Live account. But it is still a good place to learn trading.

Once you have gained enough experience & are profitable on demo for a consistent period of few months, only then you should move to Opening Live Account with real money.

Most Forex brokers have a Live Account Opening page on their website. Live this example from FxPesa's website.

Generally, the steps involved are the same. You need to fill your 'Account Information' details, your Financial Adequacy information. Then you need to submit your 2 KYC documents i.e. ID Proof & Address proof to complete the verification.

For the KYC, it is essential that you submit valid documents as this will prevent any issues during withdrawals. For ID proof you can submit copy of your Passport or any other National ID. For Address proof, you can submit your phone or any other Utility Bill.

For Live accounts, brokers can either be market makers or provide DMA (Direct Market Access) & DMA brokers are either ECN or STP. ECN (Electronic Communications Network brokers) is where the investors directly get connected to the other investors in the Forex Markets and the fee is calculated by the volumes traded by the clients that pass through the ECN environment.

STP or Straight Through Processing is where the broker passes the trades to liquidity providers for execution and gives access to interbank market structure. Even though having DMA gives you wider access to markets with higher rewards and risks, but finding true brokers providing DMA is difficult and tricky.

You should avoid brokers that are market makers as these brokers take position against you. So any loss that you make with a market maker forex broker is the profit of that broker.

All the CMA licensed online forex brokers are 'Non-Dealing' which means they don't operate a dealing desk. So, they are not market maker brokers.

If you are a beginner, you should choose brokers with standard spread accounts only where the broker preferably offers STP accounts like in case of Hotforex. The expert traders can go for ECN type account. These have low fees but commission is charged as per the trading lots.

To give you an example, HotForex has Premium Account & Zero Account. The Premium Account is spread only trading account, while Zero Account is spread + commission/lot account type.

With Premium Account the typical spread for EUR/USD is 1.3 pips. With Zero Account it is 0.1 pips + $6/Standard lot. So, if you are trading 1 Standard Lot, then the trading fees with Premium Account would be on average $13/lot. But with Zero Account it would be $7/lot on average ($6 for commission + $1 for spread).

So, if you are a trader trading high volume, it would be right decision to open your trading account with Zero Account for saving on the broker's trading fees.

Other brokers like FXPesa, Pepperstone & Exinity also have similar account types.

You can start forex trading in Kenya for as low as KSh. 500 deposit. The exact deposit requirements depend on broker to broker & are different for various payment methods.

Many brokers offer a lot of options when it comes to opening accounts with them. All these accounts require a minimum account balance.

How to check the minimum deposit for forex trading?

You can find the minimum deposit on the forex broker's website or during account opening.

Let's take an example of FxPesa. You can find their minimum deposit requirements for all their account types on their accounts page. Below is the screenshot from their accounts page.

The minimum that is generally offered by many brokers is $5 (with Hotforex, FXPesa Kenya & XM Trading) but we recommend that it would be better to open a trading account with a minimum of $500. This would ensure that a sizeable position could be taken in trading and a good profit could be earned on positive market movements.

However, it should be kept in mind that a position would depend on the balance maintained and the leverage offered by the broker. It is generally advised that a day trader shouldn’t risk more than 1% of their forex account on a single trade. That means, if your account contains $500, one should not risk more than $5 per trade.

Trading positions also depend on the lot size that one opts for. One can trade in Standard lots (100,000 units), Mini lots (10,000 units) or Micro lots (1000 units). If USD is listed second in the currency pair, like EUR/USD or AUD/USD, and your account is being funded in USD, the value of pip per lot type is fixed. Hence, value of one pip for a Micro lot, a Mini lot and a Standard lot is $0.1, $1 and $10 respectively. Knowing this information is very helpful as this would help in determining the level of risk one can take and what position to take in the trades.

Let us assume we have $500 in our account and would like to trade on Mini lots for EUR/USD, currently at 1.084. The broker offers a leverage of 100:1 and 0.4 pips in spread for the EUR/USD pair.

One Mini lot of EUR/USD can be bought with $108.4 of capital (1 Mini lot = 10,000 units * $1.084 = $10840 / 100 leverage = $108.40).

With $500 in account, we take up a position of 40,000 units or 4 Mini lots of EUR/USD pair, resulting in total capital invested be $433.6. With a positive movement of 1 pip in EUR/USD, we would gain $1 per lot. Hence, the total gain on our position would be $4. From this, we reduce the broker’s spread of 0.4 pips per lot to reach out net profit of $2.4 on our position of 40,000 units.

Starting out with a moderate amount of capital like $500 gives you the flexibility to trade as trading with very low capital & using high leverage is very risky. Generally, the very liquid forex pairs have changes in the range of 100 of pips. So, one can generate a good return if you trade wisely with low leverage. However, the risk appetite should also be kept in mind.

During volatile market conditions, using high leverage can be very risky. For example, if your account size is $1000, and you are trading 1 Standard lot, which is 1:100 leverage, then your account would be 0 with just 100 pips movement. A major currency like EUR/USD can easily move 100 pips intraday.

Below is an Intraday Chart of EUR/USD. You will noticed that the price moved almost 150-200 pips in 8 hours. If you were excessively leveraged, then your trading account would be wiped (or even go into negative), during this move.

So, it is really important to understand the concept of position sizing.

How can you deposit & withdraw for Forex Trading in Kenya

Regulated forex brokers like FXPesa, Scope Markets Kenya, PepperStone Kenya allow traders the option to fund trading account in KSh. using local bank trasfer via bank account in Kenya. With this method it can generally take upto 24 hours for the broker to credit your trading account.

You can also fund via credit/debit cards & Mobile money like MPeasa, Airtel money etc. Generally both these methods are instant for funding, and it takes few hours in case of withdrawals.

For example, the typical withdrawal time at CMA Regulated FX broker FXPesa is few hours for Ewallets & Mobile money. But it takes few days for withdrawals in your bank account.

Yes, it is legal to trade forex in Kenya, if you are doing so via a CMA licensed broker. But if you are trading through an offshore unregulated broker, you are doing so at your own risk. There is no clear mention if it is illegal, for unregulated brokers should be considered illegal.

There is a proper framework for online curreny trading in Kenya, so your funds are protected as long as you deposit it with a legal regulated broker.

Forex Trading is risky & can result in loss of your invested money, or even more than your actual investment. It is really important to understand the risks, so you can take preventive action to minimize them.

In this chapter we will highlight some of the main risks that most traders ignore.

The 4 main risks involved in forex trading are:

Forex deals with exchange rates and currency pairs. Forex market is quite volatile. As per the global financial markets, the fluctuations in exchange rates could be various economic, geopolitical, social, etc. factors. The currency pair which can give a profit today may incur a loss tomorrow.

Therefore, to cover the volatility risk, one has to study the exchange rates and currency movements very carefully.

For example, the CMA licensed forex brokers don't offer GSLO (Guaranteed Stop-Loss Orders). With this order, the broker charges a premium, and guarantees that your set stop price will be hit by the broker.

In an event, like a Central Bank Intervention, or some event, the price can move very quickly within seconds. It is also possible that your stop-loss order might not get executed at the price which you had set at your forex broker.

During such an event, your account equity can go into negative or you might incure more loss that you were willing to take, because of failure to execute at a price which you had set.

Therefore, you must understand the risk that your stop-order might not trigger at your set price, due to market conditions. By understanding this risk, you can prevent situations where there are likely events of intervention or similar triggers which can cause liquidity gaps in the FX market.

In forex trading, the risks of incurring huge losses should be covered using hedging instruments like derivatives. High leverage means trading on the capital which is not owned or is borrowed. So, if the leverage is high then the losses on that becomes a double burden on the investor to pay off.

It is important to understand that your risk is unlimited when you are trading currency pairs as CFDs. For example, if you decide that you want to short EUR/USD, based on the theory that the interest rates in the US are going to go higher, but the market does not go in your direction, your loss can be unlimited (if you are not using a Stop Loss).

Unlike options, forex trading at CFD brokers is naked shorting or longs, and the risk is not capped if you are not using any Stop Loss. Whereas in options trading, your risk is capped to the amount of your 'Premium' paid to the option writer/seller.

But with Forex Trading via CFDs, you can lose more than you entire equity, if your broker does not offer negative balance protection. Let's understand this through an example.

Trader A is Long USD/JPY at 150 (let's say because according to him/her the trend is up, so it should go to 152). But he/she did not predict that the BoJ might intervene, causing the price to go to 146 in few minutes.

If the trader A is trading 1 Standard Lot (6.69 USD per pip move). then the trader will lose almost 2600 USD in this trade. If the account balance is 10,000 USD, this make the loss 26% of your equity.

This is why CFD trading on forex or any other intrument is very risky, as there is no limit to the losses. If you are using leverage, then you can lose large percentage of your equity on a single trade.

Regulated brokers provide a guarantee of your money being used for your trading only & reduces the risk. The unregulated broker can use investor’s money for wrong purposes and may mis-lead the inventors with fraudulent schemes.

To safeguard the money invested and to cover oneself from any fraudulent practices, one must always trade with regulated brokers.

When you are trading via an unregulated broker, which means your counterparty is unlicensed to operate in Kenya, then they don't have to follow the guidelines mandated by the CMA. Unregulated broker can even act as the market maker, and take the opposite side of your trades, so when you are losing, the broker is making money.

There are only nine non-dealing Forex Brokers who are authorized by the CMA. Trading forex via any other non-licensed entity puts you at risk, and there will be no investor protection if the broker is a scam.

CMA has published their 'list of licensees' which can be verified from their website. Only the entities listed under 'non-dealing online foreign exchange brokers' are considered legal & safe for retail & professional forex traders in Kenya.

The risk-reward ratio should be calculated before investing as the markets are volatile and an investor should be sure how much money is expected to be gained and what is the maximum loss that can be incurred.

The predictable loss should always be less than the predictable profit. There must be a limit stop loss order in place that protects against loss to the minimum.

Markets can be extremely volatile during news or events. For example, the Euro currency would be extremely volatile during ECB meetings. If the market expects one thing, but the Central bank surprises, then you can expect even higher volatility.

Another major risk during such events is that your Stops might not get triggered at the desired price, due to gaps, and it can lead to higher losses & even a margin call.

The above example is of 5 Mins chart of EURUSD, and there is a nearly 100 pips spike in price during FOMC minutes.

The best way to reduce these risks is to understand Forex Market fully & learn risk management before investing.

Here are some tips that Beginner traders should stick to:

Remember, Trading CFDs are risky instruments as they involve a leverage. The loss incurred may be more than the money invested. Hence, these products should be tracked and tested on demo before trading live.

The money invested in Forex & CFDs should be kept purely for trading purposes and the investor should be ready for both profit and loss of the entire capital. The traders in the financial markets lose money, as losing is one of the aspects of trading. Therefore, do not invest any money which you can’t afford to lose.

Forex Trading in itself is not a scam, but yes there are scams in forex trading, which is also a risk. If you are not a trader, but someone is asking you to deposit your money with them, so they can trade with your money & offer you 'guaranteed' returns, avoid it. Forex Trading is extremely risky, and anyone who is claiming that he/she can offer you returns via forex trading, it is most likely a scam.

Another most common scams are related to influencers, trading gurus, who claim they have cracked the code of trading. CFDs on currencies are much more riskier than other forms of trading, because one is trading derivatives on very high leverage. So, there is no guarantee of making money from trading forex, consistently. You are very likely to lose when trading forex & other CFDs. So, consider the risks first.

All forex trading strategies are broadly divided into Fundamental & Technicals. Most traders use Technical analysis in their trading, but it is still important to learn both.

Here we will look into the basics of Fundamental trading & the Technical Analysis tips for beginners.

When you are builing your Forex Trading strategy, it is important to learn about:

Fundamental analysis involves trading bases on news reports on the economy & other factors that affect a currency's value.

Fundamentals affect the outlook of an economny. A bad economy would mean a bad currency, and vice versa. So it is important to undertand the basics of Fundamental trading.

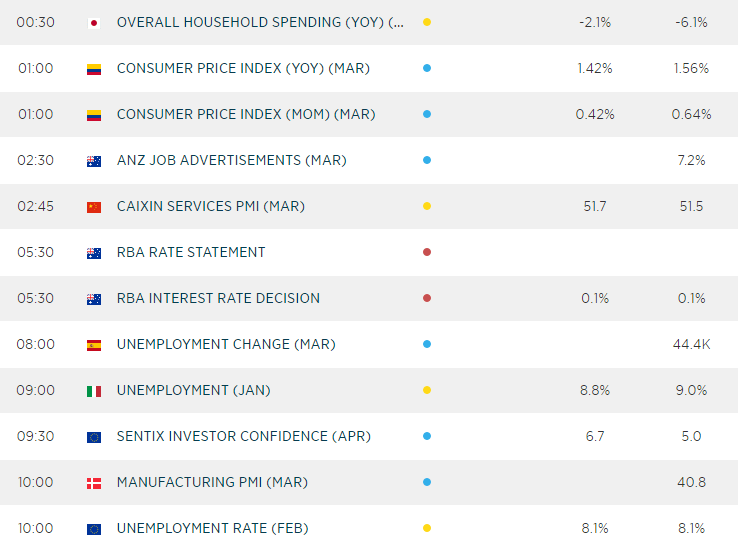

Fundamental traders keep track of news & refer to forex calenders that offer data on different fundamentals of a country's economy.

The following Economic indicators could impact a currency:

Note that fundamental events can cause very volatile price movements in currency trading. Most of the currency exchange rates move based on the differential in the exchange rates.

If there is a news like Central Bank interest rate decision, it can cause volatility in exchange rates. Let's say that the Central Bank in Japan (BoJ), decided to hike their interest rates, it will likely cause massive price movements in all JPY currency pairs.

Fundament traders also track interest rates to understand where these are headed. The most used one is the 10-year treasury yields. Generally, it is available with the symbol 'Country-code-10y' like US10Y, or DE10Y. If there is a positive surpise in the German CPI, this can cause the German 10 year yields to move higher. In turn, this would also cause the EUR/USD to move higher because market would expect higher yields in Europe.

Having an understanding of what fundamental events can affect your market positions is very important. Otherwise, you can be caught offguard, and your currency trade can go against you when you are not expecting it technically.

Technical analysis involves trading based on the charts, reading the patterns, using charting tools, indicators etc. to figure out the currency's movements.

Traders that use technical analysis read the chart using methods like candlestick patterns, Supply Demand, trendlines, support resistance etc. Below is an example of how a trading chat looks like. A technical trader would analyse different time frames as well during analysis.

There are various popular technical analysis strategies.

Trend Following: In this strategy, you following the underlying trend of the currency pair, and only take trades in the direction of the primary trend. For example, if EUR/USD is in a downtrend short-term, then you would wait for a pullback or trade the break of the previous low.

Trend followers use different indicators to help them gauge the speed of the trend. Simple indicators like moving averages are most helpful.

For example, you can use a ribbon of one slow & one fast moving average. This can be 10 day & 21 day moving average. Or for smaller time frames, you can use 2 day & 5 day moving average.

Below is an example of EUR/USD downtrend on 4-hour chart, which is moving along the short term moving averages.

Reversal Patterns: Traders who trade reversal patterns are trying to identify turning points in the FX markets.

For example, let's say that the DXY has gone up by 14% in 5 months, but a trader has identified a pivot zone that might become a reversal point, he/she can use that to place a trade for a small stop loss.

The most common reversal strategies are moving average crossovers. If the short term moving average has gone above or under the longer term moving average, it is said to be a crossover.

In the chart example below, the price was technically in an uptrend when the currency pair was holding above its short term & long term moving averages.

But once the short term moving averages cross below the longer period moving average, this can be a signal for the sellers. And for the buyers to get out or be cautious on long entries.

Session Breakout Trading: Another strategy involves trading the momentum or breakout of a session. For example, many traders trade the 'London Breakout', where they place their order in the direction of the London break.

Normally, before the start of the London session, price tends to be in a range. You can trade the break of that range. Note that when trading any range, you should be wary of a false breakout. It is common for the Frankfurt open to give you a false break, and the London open to go back into the range.

When trading any breakouts in forex, always look for a price close (emphasize that close, not the high or low), above an important level, and then look how the price reacts above it.

If the price holds above/below the range then you can take a low risk entry with small stop-loss below the previous level.

Take the above chart for example. The shaded area in blue is the Asian range, with clear edges. Once you have a clear break of the Asian range high or low, either side, you take your position, with stops above/below the other side of the range. The exit criteria ia a opposite price acion or a time based exit.

Forex trading can be very risky even for educated seasoned investors & traders. If you are just starting out, it is really important to spend as much time as you can to learn about the concepts of Forex, CFD trading; it's risks, strategies etc.

Once you have learned the basics, start by opening a demo account with a broker of your choice. Trade using that demo account until you have a good strategy that works, and has been tested over a period of 3-6 months minimum. Ony once you are fully comfortable, then you can start by investing real money. Start with low capital, and trade mini lots only. Follow all the money management lessons.