Scope Markets Kenya Review 2023

Is this CMA regulated Kenyan forex broker any good? Let's find out.

Scope Markets is CMA regulated (Capital Markets Authority) forex broker in Kenya. They are regulated under license no. 123 as SCFM Limited since 2019.

Scope Markets are one of the 4 CMA regulated brokers for non-dealing derivatives & Forex trading in Kenya. We consider them to be relatively safe considering they are locally regulated.

In terms of features, Scope Markets has a pretty decent offering. Plus, they informed us that they are a STP broker, which means there is no conflict of interest with traders.

Want to know how good (or bad) Scope Markets really is? We did the test for you, let’s see the comparison of their fees, safety, platforms & more factors.

Scope Markets Kenya Pros

- Regulated by CMA in Kenya

- It has a local office in Kenya.

- Local deposit & withdrawal methods to trader from Kenya.

- Dedicated Customer support.

- MT4, MT5 trading platforms available on all devices.

Scope Markets Kenya Cons

- Few Number of Trading Instruments.

- The minimum deposit is $100.

- Few number of accounts.

Table of Contents

- Scope Markets Kenya – A quick look

- Is Scope Markets Safe?

- Scope Markets Fees

- Account Types at Scope Markets

- How to open account with Scope Markets?

- Trading Instruments at Scope Markets

- Web & Mobile Trading Platforms

- Scope Markets Deposit & Withdrawal Methods

- Scope Markets Support

- Do we Recommend Scope Markets?

Scope Markets Kenya – A quick look

| 👌 Our verdict | #7 Forex Broker in Kenya |

| 🏦 Broker Name | Scope Markets Kenya |

| 💵 Lowest EURUSD Spread | 1.1 pips (with Silver Account) |

| 📅 Year Founded | 2014 |

| 🌐 Website | www.scopemarkets.co.ke |

| 💰 Minimum Deposit | $20 (Ksh. 2000) |

| ⚙️ Maximum Leverage | 400:1 |

| ⚖️ Regulation(s) | CMA Kenya, CySEC, FSCA |

| 🛍️ Trading Instruments | 44 Currency Pairs, 19 CFDs on Indices, Metals & Energies |

| 📱 Trading Platforms | MT5 for PC, Mac, Web, Android |

Is Scope Markets Safe?

We consider Scope Markets safe for Kenyan traders as they are regulated locally by Capital Markets Authority of Kenya (CMA).

Scope Markets is regulated by these 3 regulators:

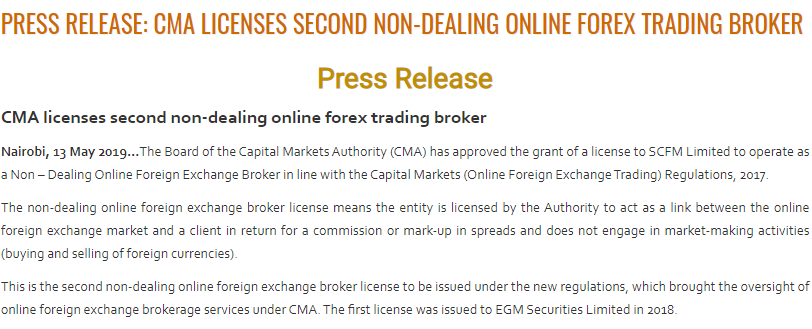

- Capital Markets Authority of Kenya (CMA Kenya): SCFM Limited is one of the 4 forex brokers licensed by CMA, since 2019 under License Number 123. Scope Markets were the second Non – Dealing Online Foreign Exchange Broker licensed b CMA.

- The Cyprus Securities and Exchange Commission (CySEC): SM Capital Markets Ltd is regulated by the CySEC (Licence No 339/17) since 2017.

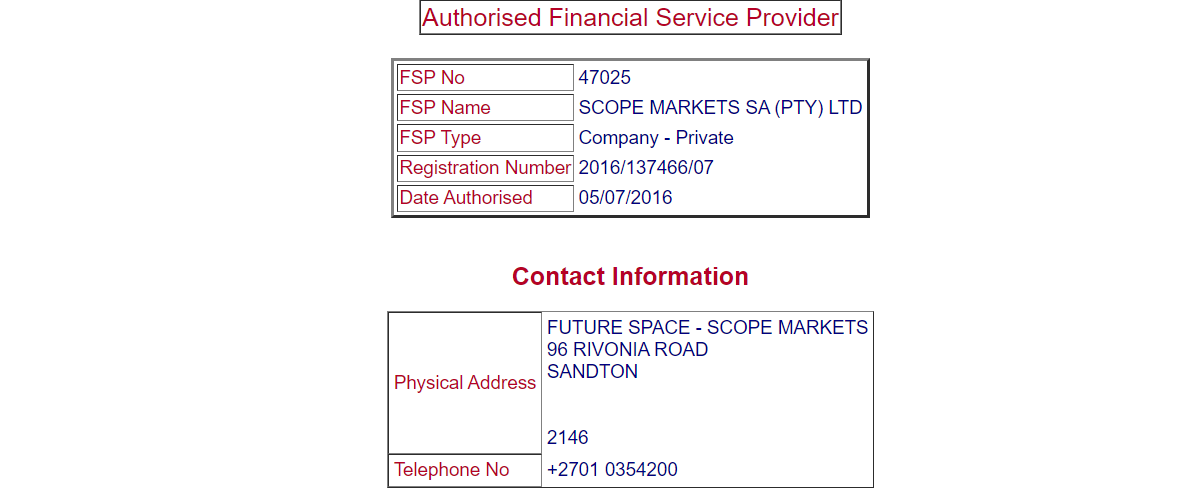

- The Financial Sector Conduct Authority (FSCA): Scope Markets SA (PTY) Ltd is authorized by the FSCA since 05/07/2016 with FSP No 47025.

Other than CMA, CySeC & FSCA, Scope Market’s is not regulated by any Top-Tier regulators.

Scope Markets is considered low risk for Kenyan traders, mainly because of the fact that they are licensed by local regulator CMA. They are locally regulated & have an office in Kenya, which makes them a legit forex broker for Kenyan traders.

Plus, they claim to have segregation of client’s funds as per the regulatory policies.

Scope Markets Fees

Trading fees are Scope Markets is not the lowest out of all the brokers that we have checked, but it is not the highest also.

Here’s a breakdown of their trading & non-trading fees:

1. Not too high Spread (but not the lowest): Their spread is variable. Just to give you an example, their Typical spread for major pair like EUR/USD with ‘Silver Account’ ranges from 1.1 to over 2 pips. On average it was around 1.7 pips when we tested.

This is around the same as competitors FXPesa but higher than XM, Hotforex & Exness. For other CFDs like Gold their typical spread is 35 pips, which is higher than other CFD brokers.

2. Commissions with Gold Account: They charge $7 commission per Standard lot with Gold account i.e. $3.5 for opening & $3.5 for closing the position.

But the spread with Gold account is lower than Silver Account. This account should be considered by high volume traders.

3. Zero Deposit/Withdrawal fees: All deposits & withdrawals including MPesa, Bank transfers are free.

4. No Inactivity fees: This information is not available on their website. But we contacted their support & were informed that ‘We do not charge for any account inactivity’.

Overall, Scope Market’s fees is simple & straightforward. It is definitely not the lowest we have seen but still it is competitive we feel.

Account Types at Scope Markets

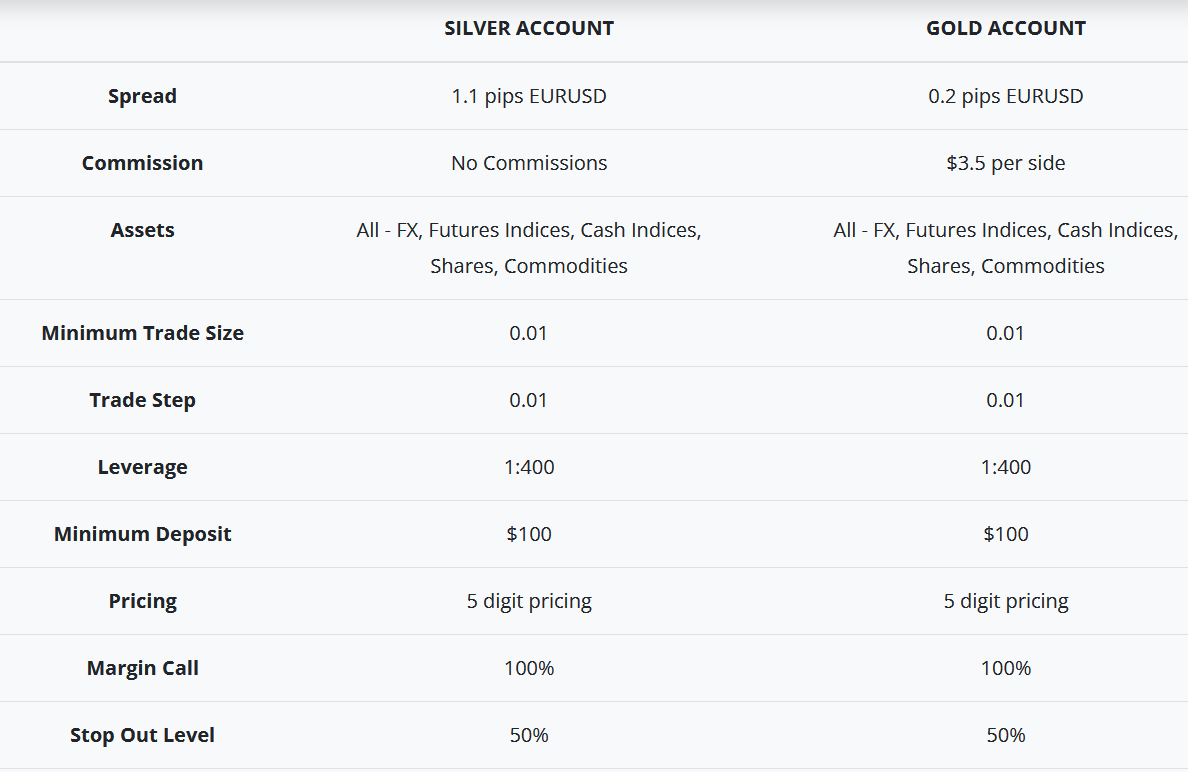

Scope Markets have 2 Live account types. One is ‘Silver Account’ & the other is ‘Gold Account’.

The minimum deposit at Scope Markets is $20 or KES equivalent with both their trading accounts. One account is spread only & the other is commission based trading account.

1. Silver Account: This is a spread only, zero commissions account. The only fees with this account is the variable spread per lot.

The max. leverage with this account is 1:400, and minimum deposit at Scope Markets Kenya is $20 or Ksh. 2000. Negative balance protection is available on request, in case your balance goes into negative.

2. Gold Account: This is an ECN type account with low typical spread from 0.2 pips but $7 commissions per lot ($3.5 on both sides). Other than that, all the features & deposit requirements are the same as their Silver account. The max. leverage is 1:400.

Account opening is simple, fully digital (online) & only takes a few minutes. You need to complete the Sign Up form on their website, and once you have done that you need to submit KYC documents for account verification.

Documents Required for account Verification at Scope Markets:

- A copy of your ID.

- KRA pin certificate.

Verification takes a maximum of 24 hours. Once you are verified, you will receive a notification on email.

They offer a free demo account as well if you are a beginner trader looking to test. Overall, their account types are quite easy to get started with.

How to open account with Scope Markets?

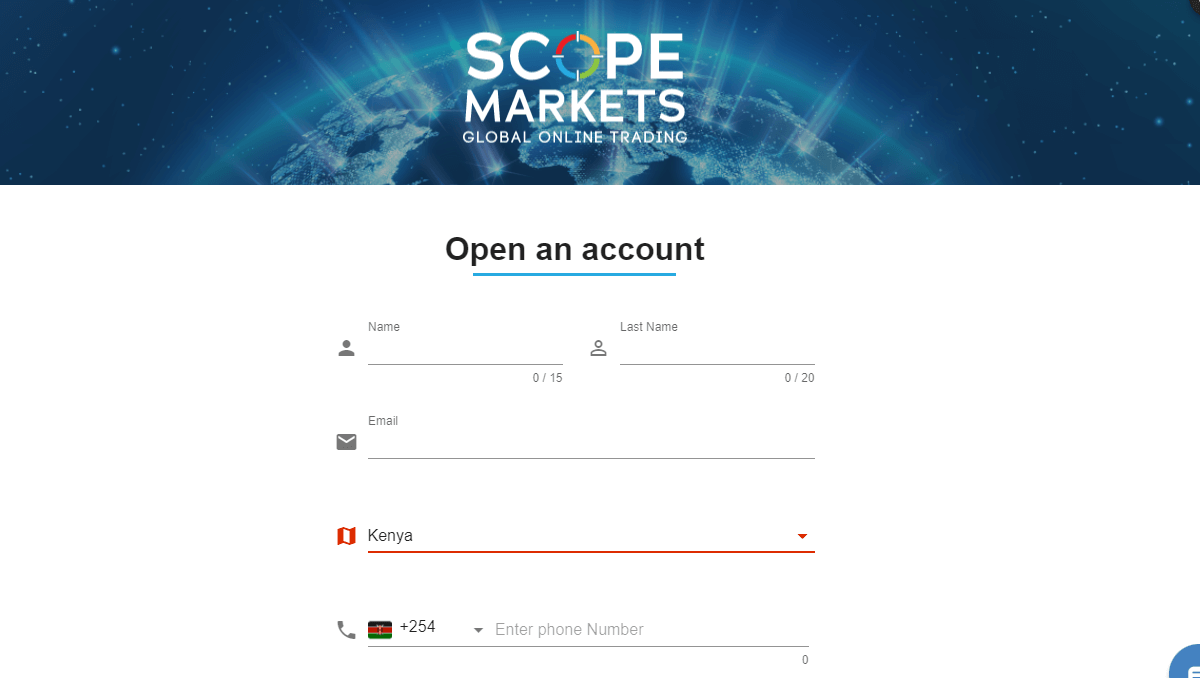

Account opening with Scope Markets does include many steps. You can follow the below steps to open account with them:

Step 1) Fill in your details: First of all, you need to go to Scope Market’s registration page and enter your required details there. You need to enter your name, email and set your account password on this same page.

Step 2) Select Trading Platforma and base currency: Now you will be redirected to a page where you need to select the trading platform and base currency for your trading account.

Step 3) Enter Personal Information: Once done with selecting the platform, you need to enter some of your personal information like your date of birth, country, address, etc.

Step 4) Upload Documents: At this step, you need to verify your identity. For this, you need to upload your ID proof and Address proof. This verification process can take some time depending upon your type of uploaded document.

Step 5) Fund your account: You can now go ahead and start funding your account using any of your preferred payment methods to start trading.

That all!

Trading Instruments at Scope Markets

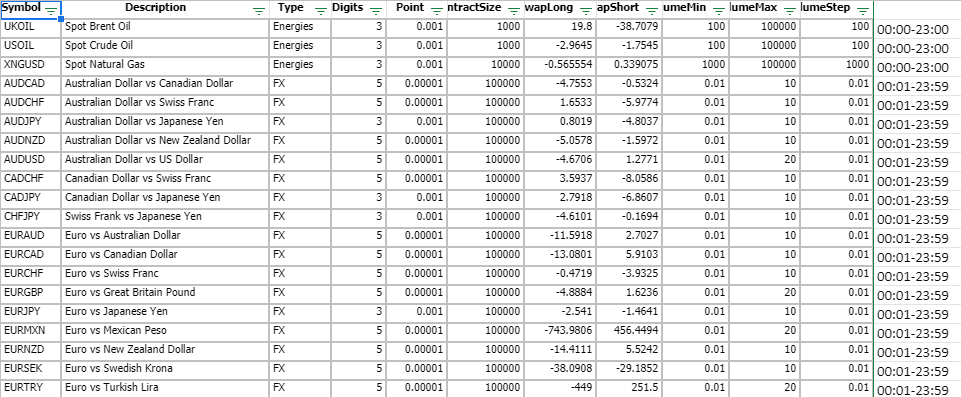

Trading instruments available on Scope Markets’s platform are very limited. They only offer 44 Forex Trading Currency pairs (including all 7 majors), CFDs on 14 Indices, 3 Energies & 2 Metals.

A total of 63 CFD trading instruments are available for trading on Scope Markets Kenya’s MT5 platform.

If you are looking to trade majors only then they are okay. But if you trade minors, exotic currency pairs & global stocks as CFDs then you might need to look for another broker.

Web & Mobile Trading Platforms

Scope Markets only offers Metatrader 5 platform for traders in Kenya. This is available in desktop, mobile apps for iOS & Android, and webtrader.

MT5 is the latest version of the Metatrader platform. It comes with easy charting tools, access to multiple indicators, multiple time frames, access for all devices, support for EAs & lots of other standard features.

We don’t like the fact that they don’t offer MT4, which is still the most used platform by forex traders worldwide. If you are comfortable with MT5 then you will find their platform to be quite easy to use.

Scope Markets Kenya is a Metatrader only forex broker, and they don’t offer any other platform or app, other than MT5.

Scope Markets Deposit & Withdrawal Methods

The deposits & withdrawals at Scope Markets Kenya are easy, and there are multiple local methods.

Scope Markets Deposit Methods

The following deposit methods are available at Scope Markets for traders in Kenya:

- Bank Transfer via your Bank account in KES.

- Mobile Money including MPesa.

- Credit/Debit Cards

- E-Wallets including Skrill & Neteller

Scope Markets Withdrawal Methods

There following methods available for withdrawals for traders in Kenya. These are the major methods & their withdrawal time:

- Bank transfer withdrawal to any bank account in Kenya. The withdrawals with this method can take 1-2 working days.

- Withdrawals via Mobile Money like MPesa. The minimum with this method is USD 5, and the withdrawals are processed within the same day if they are received before 18:00 hours Kenyan time. Normally you will receive the funds withing 24 hours.

Overall, the deposits & withdrawals at Scope Markets are easy. Although, withdrawals at other brokers like FXPesa, Exness are faster for MPesa withdrawals.

Scope Markets Support

We found the support at Scope Markets Kenya to be quick, response & very accurate in answering our questions.

You can get support at Scope Markets Kenya via following methods:

1. Responsive Live Chat: We asked their chat support so many question, but still they were very response & helpful.

Their chat support is available 24/5. We did not experience any hold time, and our queries were answered almost instantly during the day time.

We asked them all the different questions ranging from withdrawals, accounts, fees, their regulations & pretty much everything else we could think of.

2. Fair Email support: We tested by sending their support an email at [email protected]. They were pretty quick in answering our to our replies, and we got response normally within 1-2 hours max.

3. Local Phone: They have local phone numbers in Kenya that you can reach out to talk to their agents & get help.

Overall, we found Scope Market’s support to be quite good to be honest (when we tested it in June 2020).

Do we Recommend Scope Markets?

Yes, we do recommend Scope Markets to traders in Kenya if your preference is to trade with a locally regulated broker.

On the positive side, they are regulated by CMA in Kenya so you can trust them. In terms of fees, it is not too high. Their account types are very clear, and they deposit requirements are also not too high. Plus, they accept local payment methods like MPesa, bank transfers for deposits & withdrawals. And their support is pretty decent as well.

Negatively, their availability of number of trading instruments is very limited. Another thing is that they only offer MT5 trading platform, no MT4 or cTrader. Their fees for some minor forex pairs & CFD instruments is on the higher side.

Overall, we think they have scope for improvements – but you can trust them due to their Kenyan regulation.

Scope Markets Kenya FAQs

How do I withdraw money from Scope market?

What is the minimum deposit at Scope Markets Kenya?

Is Scope Markers Legit for traders in Kenya?

Does Scope Markets Kenya accept MPesa?

Scope Markets Kenya