FXPesa Review 2024

FXPesa is a popular FX trading platform in Kenya that is regulated with CMA. Their fees is simple & they have local support. But we found some downsides.

FXPesa is a popular forex & CFD trading platform for retail traders in Kenya. They were launched in 2019.

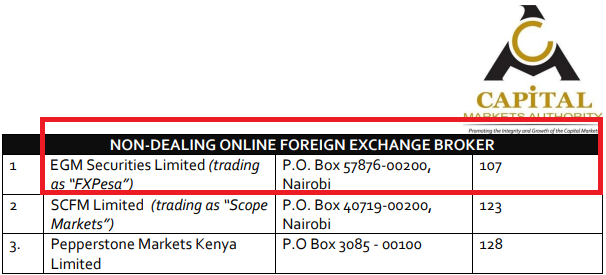

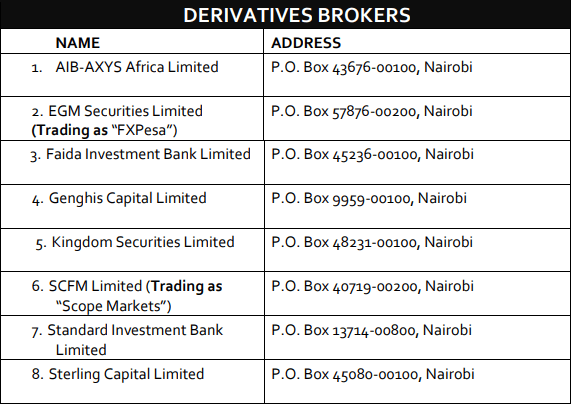

FXPesa is the trading name of EGM Securities Limited (company registration number PVT-AAAAFF7), a Non-Dealing Desk (NDD) broker providing Electronic Communications Network (ECN) execution of Forex and CFD trades and regulated by Capital Market Authority (CMA) of Kenya.

FXPesa is considered safe for Kenyan traders as their parent company is regulated by the CMA & they are well-known FX trading platform in Kenya.

Their platform is mainly for beginner traders – with all-inclusive mobile app, webtrader & MT4 for desktop.

FXPesa Kenya – A quick look

| 👌 Our verdict | #1 Forex Broker in Kenya |

| 🏦 Broker Name | EGM Securities Limited |

| 💵 Lowest EURUSD Spread | 1.4 pips (with Executive Account) |

| 📅 Year Founded | 2019 |

| 🌐 Website | www.fxpesa.com |

| 💰 Minimum Deposit | $5 |

| ⚙️ Maximum Leverage | 400:1 |

| ⚖️ Regulation(s) | Capital Markets Authority of Kenya (CMA) |

| 🛍️ Trading Instruments | 66 Forex pairs, 100+ CFDs on Shares, Commodities, Indices |

| 📱 Trading Platforms | Webtrader, Android & iOS Apps, MT4 |

| 📒 Demo Account | Yes |

| 💰 KES Base Currency | No |

Is FXPesa Safe?

Yes, FXPesa are considered safe for the Kenyan traders.

- Safety of funds is ensured by EGM Securities – which is FXPesa’s parent company. EGM Securities Limited (FXPesa) was the first non-dealing forex broker regulated by the local regulator of Kenya CMA in February 2018 under License No. 107.

The broker would be held accountable in case of any wrongdoing or mishandling of funds. They also have a local office and a phone number to reach out to.

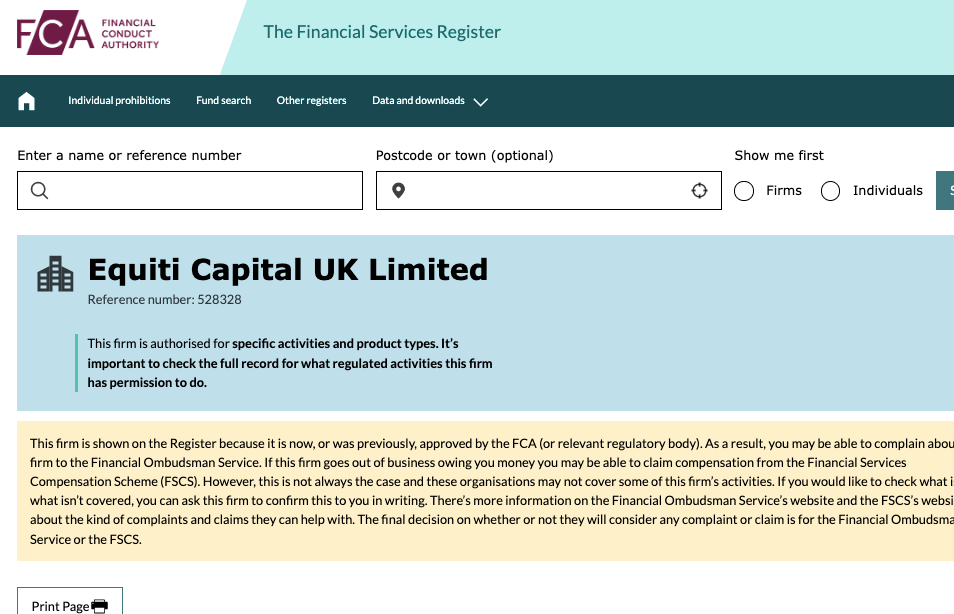

- FXPesa is also considered safe because the parent company of EGM Securities is Equiti Capital – which is a group of brokers regulated across multiple jurisdictions – one of which is regulated by the Financial Conduct Authority (FCA) of UK.

Overall FXPesa they are well regulated by the following regulators & can be considered safe for forex trading in Kenya:

- Capital Markets Authority (CMA): FXPesa is regulated as EGM Securities Limited with the local regulatory body CMA under the registration number 107.

- Financial Conduct Authority (FCA): FXPesa is also regulated as Equiti Capital UK Limited in UK with FCA under reference number 528328.

FXPesa Fees

FXPesa has a very simple fee structure. The fee charges for FXPesa are as follows:

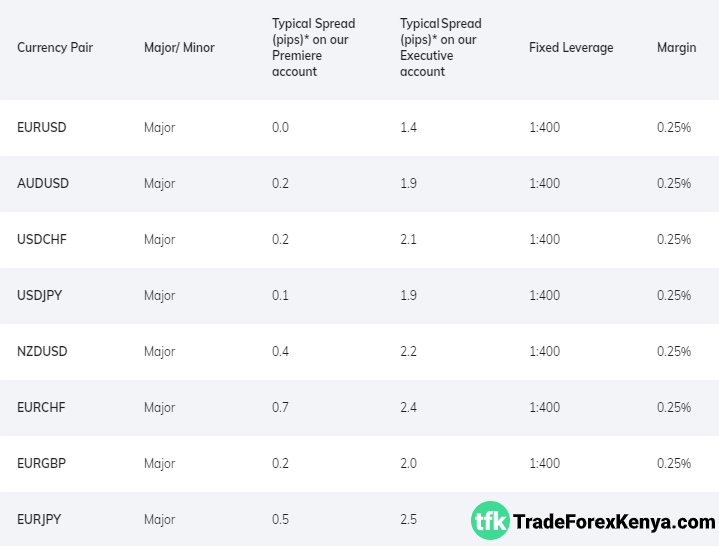

1. Spread: FXPesa charges a higher spread on standard currency pairs when compared to the other brokers.

For example, a major currency pair like EURUSD, FXPesa’s typical spread/fees charged is 1.4 pips per standard lot with Executive account. If we compare the same currency pair of EURUSD with Hotforex, they charge 1.2 pips per standard lot. This means that Hotforex provides lower spread when compared to FXPesa. Other brokers like XM Trading, too, have a lower spread of 0.8 pips per standard lot.

2. Commission(s): The only account currently offered on FXPesa is the Executive account, which is no-commission spread only account. So, there are no commissions charged for trading on FXPesa.

3. Deposit and Withdrawal Fee: All local deposit and withdrawals methods are fees free for traders in Kenya.

5. Inactivity Charges: FXPesa will charge an inactivity fee if the account is inactive for 180 calendar days or more. Activity counts as placing or closing of a trade or maintaining an open position on your account. If the account goes inactive, an inactivity fee may be applied to the account at some stage in the future and in accordance with the designated currency of the account.

As per their terms, their parent company ‘EGM Securities’ will notify its clients in advance should such a fee become payable or such closure of the account be affected.

The overall fee structure of FXPesa is simple & clear, although their spread charged on trades is a bit higher than some other brokers. There is no commission and no additional charges/fee are levied by FXPesa – making the costs easy to understand for beginner traders.

Compared to other brokers, the higher spreads is not a concerning factor, one can opt for FXPesa for the ease of trading at transparent cost that they provide.

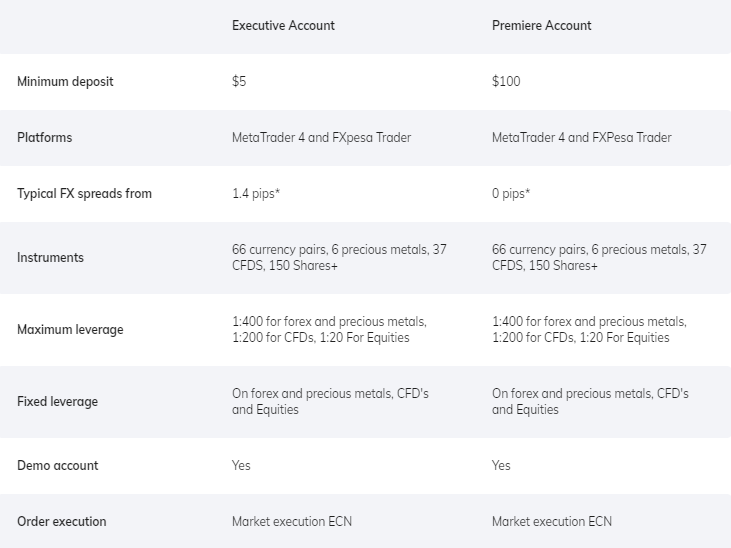

Account Types at FXPesa

FXPesa has a Standard account and a Demo account.

FXPesa Demo Account:

The Demo Account is for beginner traders where you can gain trading experience. There are many advantages of the Demo accounts. These are just like live accounts with real market pricing, and unlimited usage, access to the MT4, mobile apps and Webtrader platforms.

Note: The trading conditions in the live market may be different from demo. But you can still use demo to practice your strategy & learn.

FXPesa Live Accounts:

1) Executive Account: FXPesa offers Standard account. Their Standard account is an “Executive account” that they offer with a spread which starts from 1.4 pips, with a minimum deposit requirement of US$5 or Ksh 500 and maximum leverage of 1:400.

2) Premiere Account: The Premiere account starts with a minimum deposit of $100 with a leverage of 1:400. The spread for major currency pairs like EUR/USD starts from 0.0 pips with the commission of $7 for the round turn.

3) Swap Free MT5 Islamic Account: FxPesa offer swap free Islamic account to muslim traders. There is no interest in this account type. Traders need to check the “Islamic Account” option while opening a live trading account. You can also contact their support for converting a normal trading account to an Islamic account.

There is however no negative balance protection with their account.

Does FxPesa have KES Trading accounts?

No, FxPesa does not have KES as the account’s currency. You can only hold your trading account in USD & your trades will be settled in USD. But they do have payment methods to transfer balance in KES, which is settled in the latest exchange rates.

Is there any commissions related to FXPesa accounts?

Yes, but only with the ‘Premiere account’ under which you are charged 7 USD per lot commissions for each 100,000 units traded. If you are trading under ‘Executive Account’, there is no commission, but the spreads are higher.

For example, the typical spreads is 1.4 pips with Executive account at FxPesa, equivalent to 14 USD per 100,000 units. The spreads with Premiere account is from 0 pips, therefore the only cost for trading is through commissions, making the cost almost 50% lower with the Premiere account compared to Executive account.

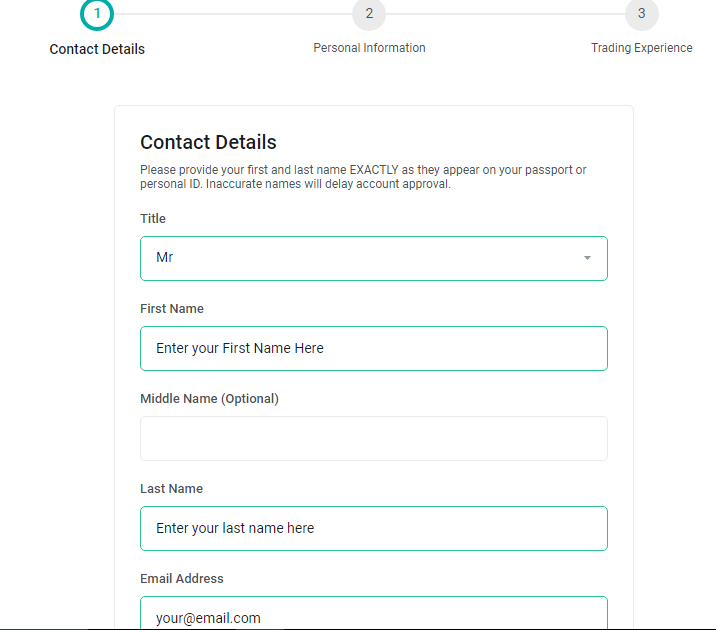

How to open live trading account with FXPesa

Opening a Live Trading Account with FXPesa does not include many steps. You can follow the below-mentioned steps to open an account with them:

Step 1) Enter the required details: First of all, you need to click on the Open Real Account button at the top of the home page of FXPesa website. After that enter the required details as shown in the below screenshot.

Step 2) Select Account Types: Now you need to select the trading account types and set the trading account password. You can select from the 2 account types that are available.

Step 3) Upload the ID proof: After login to FXPesa dashboard, you need to verify your account details which is part of KYC. You are required to upload your ID proof and Address proof for verification.

For ID Proof you can upload any valid document like copy of your Passport. For Address proof, you need to upload any bill with your registered address.

Step 4) Check Your Email: You should check your registered email as you will receive an email that includes all details of your trading account. Using those details, you can login to their platform.

After following these steps, your account will be created. Now you can log in and make a deposit & start your trading without any hassle.

Trading Instruments at FXPesa

FXPesa has somewhat limited trading instruments apart from forex compared to other brokers. Let us look at them header wise:

The range of instruments EGM Securities provides is way less than its competitors like XM or Hotforex. Let’s see the instruments available with EGM Securities:

1) Forex: FXPesa has 66 currency pairs available for trading to Kenyan traders, including 7 major pairs, 21 minor pairs and 38 exotic pairs on offer.

Although there are a few global brokers that offer higher number of FX pairs, this is still a wider variety of currencies for Forex trading, compared to many other brokers like XM, FXTM & Hotforex.

The trading currency basics like leverage, spreads, trading hours, margin all are explained in full detail on their website’s instruments page. Holiday schedule is also available in FXPesa’s website.

2) CFDs on Indices: There are 12 global Indices available. All the information like fixed leverage, contract size, commission, trading hours is available along with the holiday schedule on their website.

3) CFDs on Commodities: FXPesa offers CFD trading on 8 commodities including Gold, Silver, Oil and Platinum.

4) Share CFDs: They have a wide variety of US, UK and European shares available as CFDs on their platform.

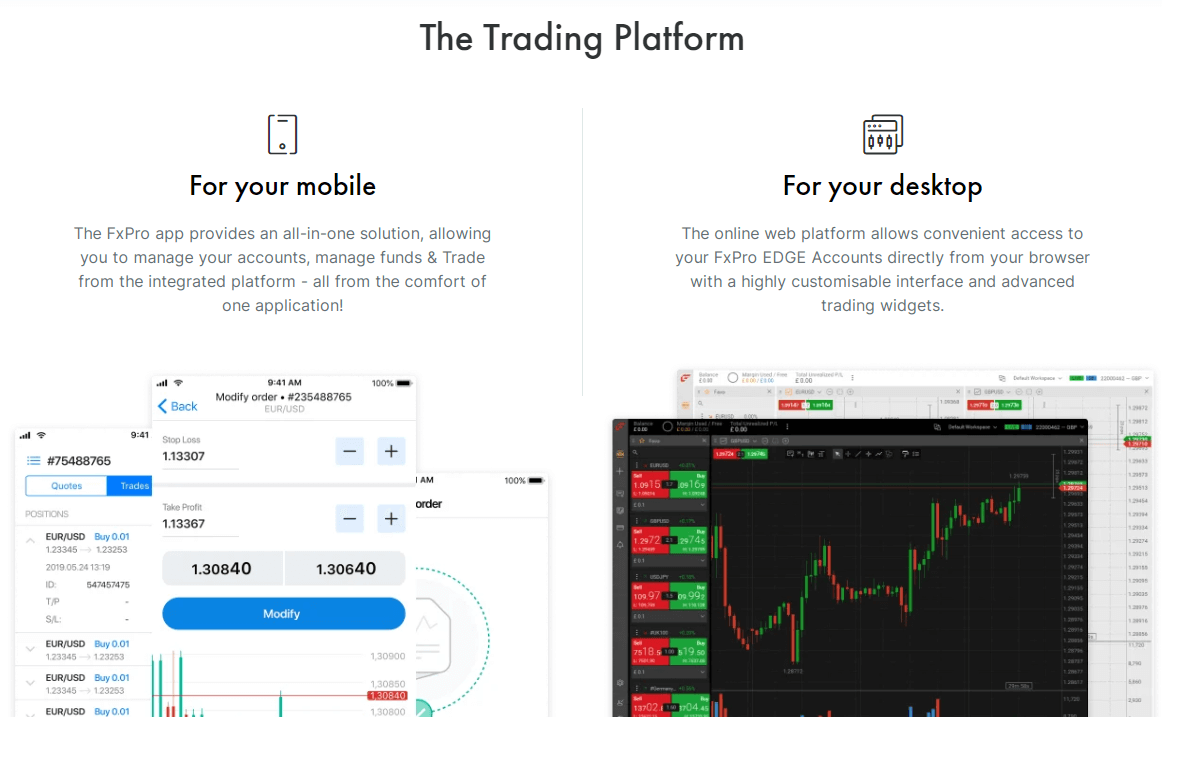

FXPesa Platforms

FXPesa provides a variety of interfaces for all devices:

1) FXPesa Mobile: FXPesa Mobile is the mobile-based trading. It is available on both Android and iOS, making it a good muli device experience. Through your mobile, you can go to MyFXPesa account management portal for trading a range of products and services.

2) FXPesa Web Trader: This is a web-based trading platform. It does not require any downloading and installing and gives instant access to your account. The market analysis can be done on web based chart with the technical indicators and drawing tools.

3) MyFXPesa: This is the comprehensive account management portal, which can be accessed from both FXPesa Trader and FXPesa Mobile. One can access their trading statements, fund their account with their preferred payment partners and set the account as per requirement. Live chat with 24/5 support is also available through the portal for any issues faced.

4) MT4: MT4 is the most popular trading platform across the globe for online forex trading. FXPesa also has MT4 platform. This has multiple functionalities and quick and stable environment for trading. MT4 makes online trading experience an easy experience.

MT4 includes automated trading and signals, advance charting tools, research and analysis tools and multi-device supports. They do not have MT5 trading platform as of yet.

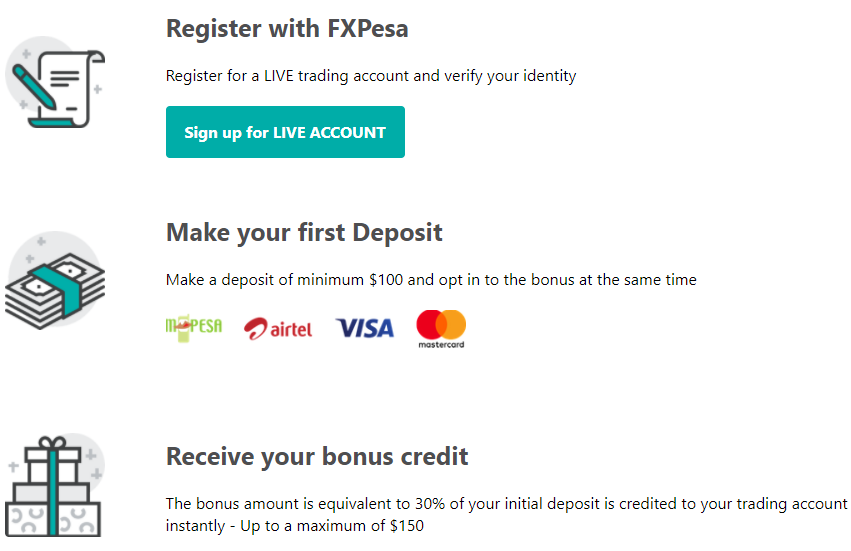

FXPesa Bonus

Currently FXPesa have a 30% bonus offer available to traders in Kenya for initial deposits. You need to make a minimum initial deposit of $100, and you can get $30 bonus with it.

The maximum bonus that you can avail with this offer is $150 i.e. you can get this bonus with $500 or higher amount deposited.

FXPesa Payment Methods

FXPesa has multiple payment methods for deposits & withdrawals in Kenya. These include MPesa, Bank Transfers, Cards & eWallets.

1. Bank Transfer: There are no extra charges for funding via Bank transfer in KES. The deposits are credited within the same day.

2. MPesa & other Mobile Money: You can also fund your account or withdraw funds via MPesa. The minimum deposit amount via MPesa at FXPesa is Kes. 500 or depending on your account type. There are no extra charges on funding or withdrawals via this method.

3. eWallets: You can also deposit & withdrawal funds at FXPesa via Skrill & Neteller. The deposits via this method are instant but the withdrawals can take 1-2 days.

Note that your withdrawal method cannot be different from your funding method (which is the same at all brokers). If you have deposited via MPesa then you cannot request withdrawal in your Skrill wallet.

FXPesa Customer Support

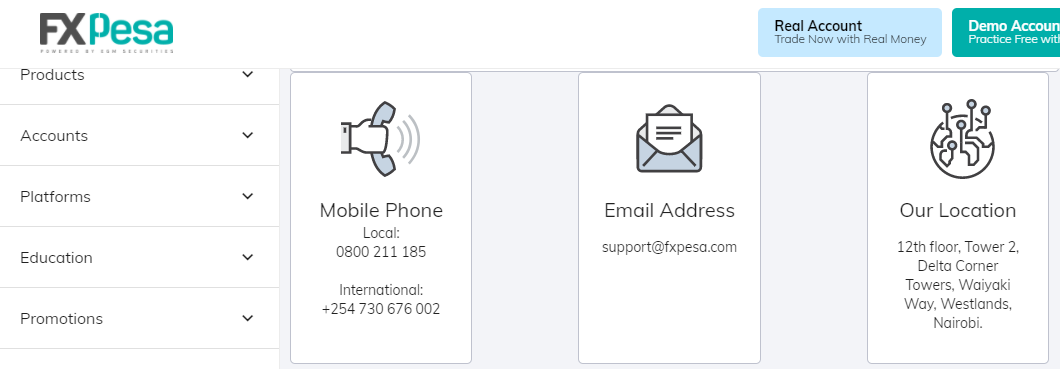

FXPesa has a 24/7 support in place. There are three ways one can contact them:

1. Live Chat: Live chat is available on their website & through the MyFXPesa account platform.

We tested their live chat during normal business hours. They have chat with 2 option “EQJO” & “Kenya support”. Their Kenya based Live chat is available during normal business hours.

Initially, their chat bot is available for basic queries, but you can chat with their team if you don’t find answers to your questions through their FAQs.

We tested it 3 different times, and found there was a hold time of few minutes, which was higher on weekend. Although the chat responses were slow, but they were accurate for our questions that we asked.

We asked questions about their brokerage model (NDD or market maker), their EURUSD spread, is any any commission etc.

2. Email Support: Our first email was answered within under 1 hour during day time. When we asked them queries over emails, there was an auto response generated and then the query was answered will full details within few hours.

3. Phone: They have a Kenyan phone number i.e. +254 207640727. We did not test their phone support for this review.

4. Local Office: They have a local office in Kenya (Nairobi).

Apart from this, there is a FAQ section where some of the queries are answered. Overall, we find their support to be fair.

Do we Recommend FXPesa?

Yes, we do recommend FXPesa for traders in Kenya.

One of the most important factor is that FXPesa’s parent company EGM Securities is regulated by CMA, which ensures surety and security for clients in Kenya.

Plus, they have multiple platforms with web-access & mobile app, and easy to use account management portal.

The number of instruments to trade with are not bad. Support is fair, and education section for learning the basics of trading adds to the advantage of trading with FXPesa.

The downsides are the higher spreads for the Forex pairs and the high minimum deposit amount. We feel this could have been lesser since the whole idea for FXPesa was to give easy access to the smaller retail investors.

Additionally, there is no negative balance protection and no ECN accounts.

Overall, we feel FXPesa is a good option to trade with for clients from Kenya.

FXPesa Kenya FAQs

What is the minimum deposit at FXPesa?

The minimum deposit at FXPesa Kenya is $5 or KES equivalent with their Executive Account. The minimum deposit with lower spread Premiere Account is $100. You can deposit via Bank Transfer, MPesa, E-Wallets without any extra fees.

Is FXPesa Legit?

Yes, FXPesa is CMA licensed Non-dealing forex broker in Kenya, and their license no. is 107. They parent company is Equiti Group which is regulated in multiple countries. So, we consider FXPesa to be a safe & legit forex broker for traders in Kenya.

What are the spreads at FXPesa?

FxPesa has spreads from 0 pips. For major like EUR/USD the average spread is 1.4 pips with no commission executive account. It is 0 pips + $0.7 per 10,000 units with Premiere account.

The exact spread varies depending on your account type & the instrument which you are trading

Does FXPesa accept Mpesa?

Yes, FXPesa does accept MPesa for deposits & wihtdrawals in Kenya. There is no extra fees with MPesa at FXPesa, and the minimum depends on your account type.

All deposits & withdrawals via MPesa are instant at FXPesa.

What is the leverage at FXPesa?

The max. leverage at FXPesa for major & minor forex pairs is 1:400. It is lower exotic currency pairs, and for other instruments like 1:200 is max. for CFDs on Indices it is 1:50. The exact leverage varies for every instrument, and you can check it on FXPesa’s platform.

1 User Reviews for FXPesa

Comments are closed.

FXPesa Kenya

We have more assets to trade, and have lowered fees with great customer care.