We reviewed 18 brokers that accepted MPesa, and have chosen only those forex brokers that are highly regulated – having minimum 2 Tier-1 & Tier-2 Regulations. All these are also having an established track record and reputation.

We have also made a comparison for their diverse plus points including trading fees, platforms, and others.

Comparison Table of Best Forex Brokers that accept MPesa in Kenya

| Forex Broker | Minimum Deposit | Lowest EUR/USD Spread | Regulation(s) | Max. Leverage | Available Instruments | Visit |

|---|---|---|---|---|---|---|

|

Minimum Deposit: KSh. 500

|

Lowest EUR/USD spread*: 0 pips

|

Regulation(s): CMA (Kenya)

|

Max. Leverage:

1:400 for FX, 1:100 for CFDs |

Available instruments: 61 currency pairs, 100+ CFDs on Indices, Commodities, Shares

|

Visit Broker | |

FxPro |

Minimum Deposit: Kes. 2000

|

Lowest EUR/USD spread*: 0.3 pips (plus $0.35 per lot with cTrader)

|

Regulation(s): FCA, FSCA, CySEC

|

Max. Leverage:

1:500 for FX majors & minors |

Available instruments: 70 currency pairs, and 100+ CFDs

|

Visit Broker |

|

Minimum Deposit: $5

|

Lowest EUR/USD spread*: 0.1 pips

|

Regulation(s): CMA, FCA, FSCA, CySEC

|

Max. Leverage:

1:400 |

Available instruments: 53 currency pairs, and 100+ CFDs

|

Visit Broker | |

|

Minimum Deposit: $5

|

Lowest EUR/USD spread*: 0.8 pips

|

Regulation(s): ASIC, CySEC

|

Max. Leverage:

1:888 |

Available instruments: 57 currency pairs, 1000+ CFDs

|

Visit Broker | |

|

Minimum Deposit: $1

|

Lowest EUR/USD spread*: 0.3 pips

|

Regulation(s): CMA, CySEC, FCA

|

Max. Leverage:

1:2000 for FX |

Available instruments: 104 currency pairs, 100+ CFDs

|

Visit Broker | |

|

Minimum Deposit: KSh. 2000 ($20)

|

Lowest EUR/USD spread*: 1.1 pips

|

Regulation(s): CMA

|

Max. Leverage:

1:500 |

Available instruments: 96 currency pairs, 30+ other CFDs on metals, indices

|

Visit Broker | |

|

Minimum Deposit: $10

|

Lowest EUR/USD spread*: 1.5 pips

|

Regulation(s): CMA, FSC of Mauritius, FCA, CySEC & FSCA

|

Max. Leverage:

1:2000 for FX with Standard Account |

Available instruments: 59 currency pairs, 200+ CFDs

|

Visit Broker | |

|

Minimum Deposit: $200

|

Lowest EUR/USD spread*: 0.6 pips

|

Regulation(s): CMA, FCA, ASIC

|

Max. Leverage:

1:400 for Forex |

Available instruments: 60+ currency pairs, 400+ CFDs

|

Visit Broker |

7 Best Forex Brokers that accept MPesa

These reputed forex brokers accept MPesa from traders in Kenya:

- FXPesa – Best Forex Broker that accepts MPesa

- FxPro – Well Regulated Forex Broker which accepts MPesa

- HFM – Low cost forex broker that accepts MPesa

- Exness – Forex Trading using MPesa at Low spread

- XM Forex – Zero Commission MPesa accepting Broker

- Scope Markets Kenya – Local Forex Broker accepting MPesa

- FXTM – CMA Regulated Forex Broker accepting MPesa

- Pepperstone – MPesa Accepting Forex Broker with Raw Spreads

Let’s compare all the pros & cons of each broker that accepts MPesa.

#1 FXPesa – Best Forex Broker that accepts MPesa in Kenya

Regulations: CMA Kenya

Minimum Deposit: Ksh. 500 or $5

Trading Fees: From 1.5 pips for EUR/USD with Standard account

EGM Securities is the parent company of FXPesa. They are among the only 6 Forex Brokers in Kenya regulated by CMA – Capital Markets Authority. So, they are regulated and considered safe for traders in Kenya.

In comparison with other brokers, FXPesa charges a higher spread on standard currency pairs. For a major currency pair like EUR/USD, the typical spread is 1.6 pips per standard lot. They offer trading on MT4, Web Trader, and Mobile platforms.

FXPesa offers only a single account type to traders. It is a no-commission – spread only account. The minimum deposit required is $5 and maximum leverage is 1:400. Deposits and withdrawals with FXPesa do not have fees.

66 Pairs of Currency are offered to trade on FXPesa’s platform. Their other instruments are limited – include 12 global Indices, a wide variety of Share CFDs, and CFDs on 8 commodities including Platinum, Silver, Gold, and Oil.

Customer Support offered by FXPesa is good. During our test, the Live Chat response was a bit slow though with some holding at times. The E-mail response to our queries was in under 1 hour. FXPesa does offer support & sales through a phone number in Kenya.

FXPesa Pros

- FXPesa’s parent company EGN Securities is CMA regulated. So, considered safe.

- The fee structure is very simple.

- Their support is very good. They also offer local phone number for support to traders in Kenya.

FXPesa Cons

- Higher spreads of 1.6 pips and above.

- Limited CFD instruments other than forex.

#2 FxPro – Well Regulated Forex Broker which accepts MPesa

Regulations: FCA (UK), FSCA, FSA

Minimum Deposit: Kes. 2000

Commission/Trading Fees (benchmark): On average, 0.45 pips for EUR/USD with cTrader account plus $0.7 commission per lot.

FxPro is not regulated with CMA in Kenya. They are a FCA regulated forex broker that also accept deposits & withdrawals via MPesa.

FxPro is a well regulated CFD broker, that is regulated with multiple top-tier regulations including FCA, FSCA & CySEC. They are also a very reputable broker which has been operating for more than 15 years. This makes them a legit forex broker.

The fees at FxPro are moderate (not the lowest). For major instrument like GBP/USD, their typical spread with MT4 market execution account is 1.82 pips.

If you are trading on cTrader, then the lowest spreads for GBP/USD is 0.30 pips, plus $0.35 commission per lot for each side. That would make it a roundturn commission of $0.7 per 10,000 units (mini lot). So, for trading 1 mini lot of GBP/USD, the average trading fees would be $1 i.e. a typical spread of 1 pips.

Their trading fees overall is moderately low.

FxPro has all the major trading platforms on all devices, including web, desktop, Android & iOS. You can trade on MT4, MT5 or the cTrader.

The minimum deposit for payment via MPesa is Kes. 2000 & the deposit time is instant. The withdrawal amount minimum is also the same, and the withdrawals are completed within few hours.

The support at FxPro as per our tests is good. But they don’t have a local phone number or office in Kenya. You can request a call back (by filling the form, and their support team will call you), or you can use the live chat on their website. You can also reach them via their email.

FxPro Pros

- FxPro is regulated with FCA & other major tier-1 & tier-2 regulations.

- Offers Mt4, MT5 & cTraders platforms.

- The funding & withdrawals via MPesa don’t have any extra charges.

- Their average spreads with cTrader account are moderate to low for must of the currency pairs & other CFDs.

- Their customer support is okay.

FxPro Cons

- FxPro is not regulated with CMA in Kenya. They are regulated with foreign regulation.

- They don’t have local phone no. for support in Kenya.

#3 HFM – Low cost forex broker that accepts MPesa

Regulations: CMA (Kenya), FCA (UK), FSCA, FSA

Minimum Deposit: $5

Commission/Trading Fees (benchmark): On average, 1.3 pips for EUR/USD trade with Premium Account. 0.1 pips plus $6 per Standard Lot with Zero Account.

HF Markets (formerly HotForex) is a CMA licensed Non-dealing forex broker, and they were authorized in 2021.

HFM is a legit forex broker successfully operating in the industry for 10 plus years. They are extremely well regulated – including with 1 Tier-1 & multiple Tier-2 Regulators. Their regulations include the FCA – Financial Conduct Authority and FSCA – Financial Security Conduct Authority (FSP No.46632) & CMA (License No. 155). Thus HotForex is considered safe for traders in Kenya.

HFM has competitive fees with the Premium Account. You are not charged for withdrawals or deposits through MPesa. The average USD/EUR spread with the Premium Account is 1.2 pips. This account needs a minimum deposit of $100. However, the Micro Account needs just a $5 deposit for activation.

Premium is free of commission – spread only trading account. The Zero Account meanwhile has a low spread + $6 per 100,000 units (1 standard lot) for majors. For minor currency pairs, the commission is $7/lot.

Trading on the latest MT4 and MT5 platforms for all devices are offered by HF.

There are 53 currency pairs available for trading at HFM platform – that includes majors, minors, and exotic. Its trading assets also include 4 Cryptocurrencies, CFDs on 56 shares, 8 Commodities, leading 11 Indices globally, 3 top global Bonds, Energies such as Brent Oil, Crude Oil, US Natural Gas, and Spot Metals – Gold and Silver.

HF Markets has excellent customer support as per our tests. Live Chat is available 24 hours on weekdays. We did not experience a hold time of more than 60 seconds during our tests when connecting.

E-mail response to your queries is quite fair. We received a reply usually within 2 hours on weekdays. But HF Markets does not have local phone support for traders in Kenya. Nevertheless, overall Customer Support services are good.

HFM Pros

- HFM is regulated with CMA & multiple regulators in different countries. So they are considered a safe broker for trading forex in Kenya.

- STP (Straight through Processor) forex broker, so there is no conflict of interest.

- No fees are charged for your withdrawals or deposits, including no fees for MPesa.

- Offers some of the most generous bonuses to new traders, especially 100% credit bonus.

- Quick execution of trades.

- Spreads are tight.

- Excellent and very helpful Customer Support.

HFM Cons

- The spreads with Micro account are high.

#4 Exness – Low spread forex Trading using MPesa

Regulations: FCA (UK), CySEC of Cyprus

Minimum Deposit: $1

Trading Fees: As low as 0.1 pips for EUR/USD

Exness has been operating from 2008 and is regulated by multiple Tier-1 and Tier-2 Regulators. These include the FCA (UK) and CYSEC – Cyprus Securities and Exchange Commission.

Exness is also regulated with CMA as Tadenex Limited (Trading as Exness), with License No. 162. So they are considered safe for forex traders in Kenya.

Spread with Exness is variable based on account type but generally they have tight spreads. The Spreads for Standard Cent Account begin from 0.3 pips. There is no commission on the trading volume, other than spread. For Standard Account – the costs are based on tight spreads starting from 0.1 pips. The spreads overall are very low with Exness.

You can open an account with Exness with as less a $1. The Professional Account however requires a $200 deposit. Professional ECN Account has raw spread with a commission for each trade. The fees with Pro accounts is lower, as the spread is lower, but there is extra commission per trade.

For example, with Pro account, the spread can be as low as 0 pips for major currency pairs, but there is extra commission of $7 per lot. So, if you are trading EURUSD, and the spread is 0 pips, with commission of $0.7 for 1 mini lot, then this is comparable to 0.7 pips of spread at other brokers. This spread is quite competitive in comparison.

A MetaTrader only broker, Exness offers you to trade on both MT5 and MT4 Platforms. Trade executions are almost instant. Like HFM, there are no fees for withdrawals and deposits.

Exness does not charge any extra commission for deposit & withdrawals via Mpesa.

Exness offers multiple instrument classes, including trading forex on 107 pairs of currencies. It also includes 7 Cryptocurrencies, Metals, Energies, and CFDs on Indices and Stocks.

Customer Support at Exness is available 24X5. This is via Live Chat and E-mail. Live Chat Support in the English language is offered 24X7. They offer quite good support to the traders as per our tests. However, they too do not offer support through a local phone in Kenya.

Exness Pros

- Exness is regulated with multiple regulators.

- Several types of accounts and methods of execution, suitable for both Professionals and beginners.

- Higher options of currency pairs available for trading forex.

- MT4 & MT5 platforms, with advanced range of tools and analysis for research.

Exness Cons

- Limited account base currency options.

- Limited CFDs other than forex.

- No local phone support in Kenya.

#5 XM Forex – Zero Commission MPesa accepting Broker

Regulations: ASIC, CySEC of Cyprus

Minimum Deposit: $5

Trading Fees: As low as 0.8 pips for EUR/USD with Ultra Low account

XM Forex is also a highly regulated Forex broker that is regulated with top-tier global Financial Authorities. These include the ASIC & CYSEC. XM broker is one of the largest forex brokers in the world & is well reputed. It is thus regarded as quite secure for traders.

XM charges fees with their account only through the spread. They do not charge any additional commission per lot. The fees for XM Ultra-Low Account are among the lowest among leading Forex brokers.

The Ultra-Low Account as per our benchmark with the EUR/USD has average spread of as low as 0.8 pips.

The minimum deposit required for opening an XM Account is $5. The leverage offered to traders is 1:888. Traders get to trade in 57 Currency pairs and 1, 183 Stock CFDs. The other asset classes are 9 Equity indices CFDs, 5 CFDs on Energies, 10 Commodity CFDs, and 4 Precious Metals CFDs. XM however does not offer Crypto CFDs.

XM offers customer Support 24X7 via E-mail and Live Chat. We did not experience a hold time of more than 2 minutes when we tested their support with Live Chat at 3 different occasions. They offered us fast & accurate responses to all your queries on their fees, regulations, funding & withdrawals.

A local phone number support in Kenya is not offered by XM. You can however request a call back through E-mail or Live Chat.

XM Broker Pros

- Regulated by ASIC, and CYSEC

- Ultra-Low Account offers very low standard spread for EUR/USD with 0.8 pips.

- Quick execution of orders and nil re-quotes.

- Negative balance protection offered.

- Withdrawals and deposit fees are not charged.

- Well-informed and quick support via Live Chat.

XM Broker Cons

- Phone number support in Kenya not available.

- Limited CFDs other than forex.

- XM does not offer CFD trading on Cryptos.

#6 Scope Markets Kenya – Local forex broker that accepts MPesa

Regulations: CMA

Minimum Deposit: $20

Commission/Trading Fees (benchmark): Lowest, 1.1 pips for EUR/USD

Scope Markets (SCFM Limited) is licensed with CMA as non-dealing online foreign exchange broker with license no. 123. So, they are considered low-risk for depositing you funds with.

Scope Markets accepts MPesa with Instant Deposits & Withdrawals when you are using this payment method. Their minimum deposit is 100 USD, but they only offer USD account currency, KES base currency accounts are not available.

There are 2 trading account options at Scope Markets Kenya. One is ‘Silver Account’ which is a spread only account type, with typical spreads of 1.1 pips for trading EUR/USD.

The second account type is ‘Gold Account’ which is a commission based trading account, with typical spreads for EUR/USD of 0.2 pips plus 0.7 USD commission per 10,000 units (mini lot). Therefore, this would be equivalent to an average spread of 0.9 pips for EUR/USD.

You can trade CFDs on 96 currency pairs, CFDs on indices, stocks & commodities. So, the total CFDs on asset classes is wide at Scope Markets Kenya, compared to FXPesa & HFM.

Scope Markets have a local phone number & address in Kenya. They also have live chat on their website, but there is a hold time of few minutes.

#7 FXTM – CMA Regulated Forex Broker accepting MPesa

Regulations: CMA, FCA, FSCA, CySEC

Minimum Deposit: $10

Trading Fees: From 2.1 pips for EUR/USD with Cent account

ForexTime is regulated in diverse jurisdictions globally. Their top-tier Financial Regulations are with CMA, FCA, CYSEC, and FSCA (FSP No. 46614).

But a higher average spread is charged with FXTM’s Standard accounts as per our benchmark test for EUR/USD. The Standard Account has an average of higher than 2.1 pips spread. The FXTM Cent Account has even higher spread.

FXTM charges commission for its ECN Account. This is $2 for each side which adds to $ 4 per trade for 1 Standard lot. All deposits are free of charge at FXTM, including for MPesa. However, there are fees for withdrawals depending on the method.

The minimum deposit to open an FXTM Cent Account is $10. The Standard Account requires $100.

You can trade with FXTM through the MetaTrader 4 and 5 platforms. Their financial instruments include Forex Currency Pairs, Cryptocurrencies, Stocks, CFDs, Commodities, and Precious metals.

FXTM offers fair customer support. Live Chat offers a quick response and we did not find any hold times of over a minute during our test. We got a response to our queries within 3 hours through E-mail on a weekday. They do not have a local phone number in Kenya.

FXTM Pros

- Well regulated with multiple regulators.

- Account opening process is fast.

- Good educational section on their website.

FXTM Cons

- High trading fees on forex & CFDs. Also, fees for Withdrawal and Inactivity.

- No local phone number dedicated for Kenya.

How we selected the Best MPesa Accepting Forex Brokers?

Here are the major factors that we have considered while reviewing the Forex Brokers accepting MPesa:

1. Top-tier Regulation(s): The most crucial factor is the number of Tier-1 Regulators that regulate the Forex Broker. FCA, ASIC, NFA are considered as Tier-1 by the Forex industry. FSCA and CYSEC are Tier-2 Regulators. If the Forex Broker is listed publicly in a major Stock Exchange, then it is an extra trust factor.

Also, if the forex broker is regulated by CMA in Kenya then it is considered safe. This is most important to check in your forex broker.

If a broker is licensed by CMA & other major regulators as well, then it means the broker is reputed & can be trusted. For example, HFM is regulated with the CMA, but they are also licensed by FCA, FSCA & CySEC. This makes them a well-regulated forex broker with low risk.

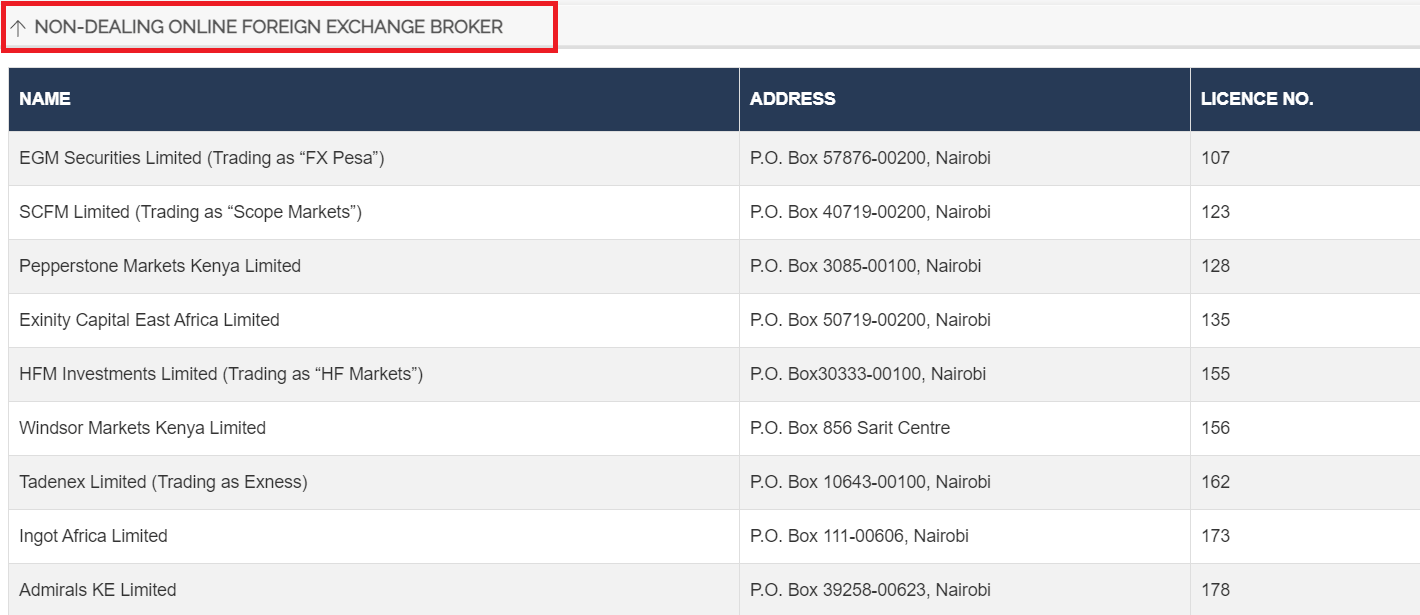

There are just 9 Forex Brokers licensed with Kenya’s CMA, if you are looking to trade with only a local broker. One of them is FXPesa.

You should always check the forex broker’s license number & verify it from the regulator’s website. Regulated brokers like FxPesa have a ‘regulations’ related page on their website where you can check & verify the regulators with whom the broker is regulated.

Once you have the license no. then go to CMA’s website for the ‘List of Licensees’. Verify the broker under ‘Non-dealing Online Forex brokers’. If your broker is in that list, it means they are considered legal & safe for you to trade with.

Avoid any fake & unlicensed broker. If the broker is not regulated with CMA or any other Top-tier regulation, don’t open account with such broker. There is a high risk that you could lose your deposits with such broker.

Some fake brokers also create clone websites which imitate that of regulated brokers. For example, a fake broker can create a similar looking website & domains (website address), but they might actually be fake. Don’t trust any messages on Whatsapp from people claiming to be associated with the broker. Such scammers can try to get your account passwords, or even make you deposit on scam websites.

2. Overall Fees: The factors considered here are spread, commissions, and charges on withdrawals and deposits.

Majority of the brokers charge fees for Dormant/Inactive Accounts too. Some of them also levy extra fees where you are trading other CFD instruments. So, it is vital to research the overall fees of the asset that you are seeking to trade.

All regulated CFD brokers have spread comparison table. Make sure to check the fees for the instrument that you want to trade, and see if there is any other regulated broker offering the same instrument at lower fees.

As an example, if you want to trade CFDs on Gold, then compare the fees for XAU/USD instrument offered by the broker. Also check the contract’s lot size & if there are any extra commissions.

Like, the broker in the below table has 0.32 pips typical fees for Gold CFDs. There are other brokers with lower fees also.

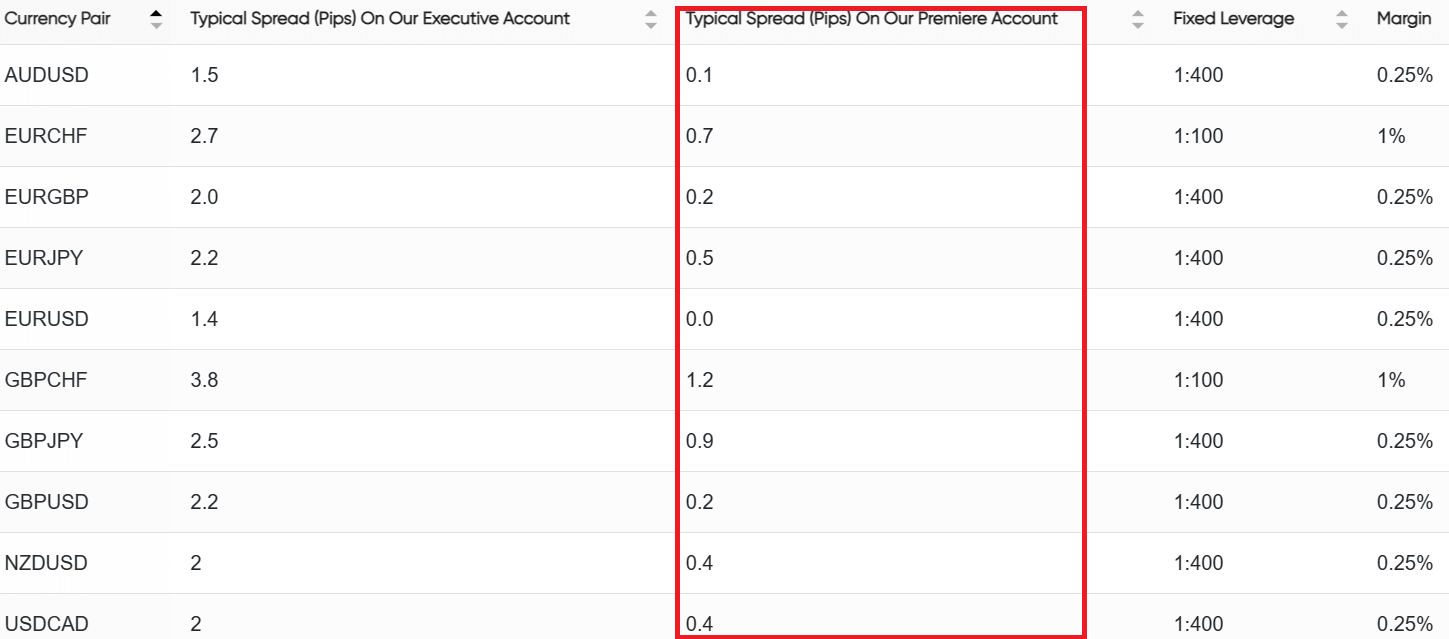

There may even be extra commissions involved apart from the spreads if your account type is Commission based. FxPesa for example has ‘Premiere account’, which involves commissions per lot for your trading activity.

If you look at their table of typical spreads, you will notice lower spreads with Premium Account, compared to Executive Account. For example, the spreads on trading GBPUSD is 0.2 pips compared to 2.2 pips with Executive account.

But there is a commission of $7/lot (or $0.7 per 10,000 units) with the Premiere account. If you add this up, the total cost of trading GBPUSD will be 0.7+0.2 which is equivalent to 0.9 pips spread. This is very low compared to the fees they charge for same instrument with spread only account

Therefore, you must carefully examine & calculate the trading fees which you will pay.

Also, some brokers may charge fees for funding & withdrawals via MPesa, or during conversion. For ex. FXPesa, Pepperstone, Exness don’t charge any extra fees on funding & withdrawals via MPesa in KES.

But if your account is in another base currency like USD, then your funds may be converted into KES at a lower exchange rates than the actual rates. So, you need to consider this commission too. Although it is not necessarily that the broker is charging this fees, it could be their gateway charging this conversion commission.

For example, if the broker charges KES100 for every withdrawals, and your withdrawal amount is KES10,000, then in percentage terms, the fees is 1% of your capital. Giving 1% of your capital just to withdraw funds is not viable, and you should avoid any broker that charges extra (excess) fees via other methods such as withdrawal charges, or inactivity fees.

Important Note: Many brokers charge inactivity fees if your account does not have any transaction or trade over a period of time. For example, if you have not placed a trade for 3 months & your broker has an inactivity period of 3 months, they would deduce the inactivity fees from your balance every month, till your account balance goes to Zero.

It is not uncommon for forex brokers to charge $5-10 of inactivity fees per month. You should carefully read the terms of the broker, or ask the broker’s support before signing up, if there is any inactivity fees involved.

3. Solid Trading Platform on Mobile & Desktop: The Broker must offer a well-equipped and user-friendly trading platform.

Also, there must be multi-device support, quick execution, no freezing, and multiple order types. These can significantly enhance your trading comfort.

All the 4 regulated forex brokers in Kenya offer the MetaTrader platform. It is available on mobile, desktop & web, so you will have more choice. But it does not mean that all the 4 brokers will have the same MetaTrader, there would still be difference in order execution & some features may not be available.

If you are using custom EA, or some indicator, then make sure to check on the broker’s demo platform if they do allow/support it or not. Also, does the broker’s platform & app has news feature? Look for all the features that you would need to actively manage your trading positions.

4. Easy & Quick Account Opening: The Account opening must be easy and fast. The approval of the account upon submission of documents (ID & Address proof) must not take more than 48 hours.

In generally, all the 6 regulated forex brokers have the same KYC procedure. And the trading account is normally approved within the same day, if all the documents are complete.

You must make sure to submit your genuine documents, otherwise you would face issues during withdrawal of funds from your trading account.

5. Overall Trading Conditions: The execution of orders must be fast without slippage or re-quotes. The best option is to choose a Broker offering Direct Market Access than Market Maker Brokers.

The forex brokers that are regulated by CMA are ‘non-dealing members’ which you can see in the screenshot below. This means these brokers cannot act as the counter-party to your trades & can only link you to other participants.

So, when you are trading through HF Markets for example, your order would likely be sent through the broker’s interbank partner which will link your order to another party. And the broker will make money off of your spreads.

But if the broker is a market marker broker that acts as the counter-party to your trades, there is a conflict of interest. Some brokers like XM uses their offshore entity as the counter-party to your trades (which they claim is to offer better execution).

Therefore, you must decide if you are okay with a market maker or you want to trade via a non-dealing broker.

You must also be offered negative balance protection so that the loss does not exceed the account balance. Availability of guaranteed stop-loss protection is also an advantage.

The Broker must also offer funds segregation for the security of funds. The number of available product classes/trading instruments is also a factor. You must also check if the instrument that you are looking to trade is offered for the lowest fees or not.

6. How is the Customer Support: Customer Support must be accessible 24X5 through Live Chat, E-mail, and Phone. The Chat Support must be helpful with minimal hold time. The E-mail revert to your queries must be quick and preferably within 1 or 2 hours max.

The local phone number support in Kenya will be another plus point. The Knowledge base must provide instant solutions.

Check if the broker has a Kenyan phone number on their website. Also, the local brokers will have an Office address where you can visit. All the 6 regulated Non-dealing forex brokers in Kenya have these info on their website.

Let’s take CMA Regulated Forex broker Pepperstone as an example. They have listed their Kenyan phone no. on their contact page.

Similarly, all the other brokers will list their phone & other contact details on their contact page. Try reaching out to those contacts & see how well the broker responds to your questions asked.

Which Trading App has the lowest Mpesa deposit?

According to our research, Exness, FxPesa & HFM have the lowest deposits when you are funding via MPesa. In general it is around $10 or equivalent in KES.

But it is important to note that when funding via MPesa, there are restrictions on the maximum deposit amount & withdrawals. For example, at Exness the max. deposit for MPesa users is USD 620 (equivalent in KES). You cannot deposit more than that amount in a single transaction.

Also, there are similar restrictions on deposits & withdrawals at other brokers when you are using MPesa.

How much do MPesa Forex Brokers charge for trading?

The exact fees is varaible in the form of spreads between bid & ask prices. For example, the lowest spreads at MPesa accepting forex brokers for trading GBP/USD is 0.5 pips in normal market conditions.

This is $50 per million USD of trading, or 10 Standard Lot contracts. Some brokers have higher fees as well, of around 200 USD per 1 million units traded.

Check the fees that your broker charges for spreads. You will see this exactly in your Metatrader platform at your broker.

Frequently asked questions: Forex Brokers that accept MPesa

Which reputed forex brokers accept MPesa?

As per our research, HF Markets & Exness offer the best trading conditions for traders, and both of them accept MPesa with zero fees on funding & withdrawals.

If you are looking for a local broker that has office in Kenya, then we recommend FXPesa, which is the brand of EGM Securities – a CMA regulated broker.

What is the minimum deposit required for Forex Trading using MPesa?

Here is a brief overview for traders in Kenya:

How can you start trading forex in Kenya using MPesa?

You should start by learning forex trading. If you are a beginner then start by reading our Forex Trading for Beginners guide.

Once you have understanding of the concepts like Technical analysis, risk management & Fundamentals, then you can take then next step & open demo account with the broker of your choice.

Only when you are profitable on demo, you should open live account with a regulated broker that accepts MPesa & has low minimum deposit requirements. After trading, analyze all your trades & only scale if you have good understanding of all the risks & trading strategy.