HFM (HF Markets) Review 2023

Is HFM (HF Markets) broker good for traders in Kenya? Let's find out.

HFM (HF Markets) is one of our recommended broker for Forex Trading in Kenya. HFM (HF Markets) is a global forex & CFD broker that has been in the market for more than ten years now.

HFM (HF Markets) is also regulated with CMA in Kenya, this makes them a low-risk forex & CFD broker.

HFM (HF Markets) provides trading services in many other CFD instruments apart from Forex and has both retail and institutional clients. HFM (HF Markets) is one of the largest forex brokers in the world in terms of daily FX trading volume. They claim to have over 2,000,000 live account clients.

If you are in a hurry, we have listed quick pros & cons.

HFM (HF Markets) Pros

- Regulation: Regulated by CMA.

- Fees: Their trading fees is low.

- Local Deposit: Accepts deposit from Local Banks in Kenya.

- Base Currency: Traders from Kenya set KES as base currency.

HFM (HF Markets) Cons

- Islamic account: Not offering Islamic Account

- Base Currency: Low number of base currencies.

- Support: Chat not available 24/7.

HFM (HF Markets) is a 100% STP Broker. An STP (Straight Through Processing) broker will pass a client execution order directly to its liquidity provider. In other words, the broker will not be filtering the orders through any dealing desk and has a Market Execution policy.

Hence, all the orders will be executed in the live market conditions and at the real market prices. In short, the absence of a dealing desk (No Deal Desk or NDD) is what makes the broker’s trading platform STP, and more transparent without any intervention. So there is no conflict of interest like in case of market maker brokers.

HFM (HF Markets) provides good trading conditions and fast order execution. And they also provide good customer service, with quick live chat as per our tests.

We looked into different services and features like safety and regulation, fee structure, account types, trading instruments, trading platforms, etc.

Here’s why we think HFM (HF Markets) is the best broker for traders in Kenya and why we recommend it. Use the below index to find the desired information regarding HFM (HF Markets).

Table of Contents

HFM (HF Markets) – A quick look

| 👌 Our verdict | #4 Best Overall Forex Broker in Kenya |

| 🏦 Broker Name | HFM Investments Limited |

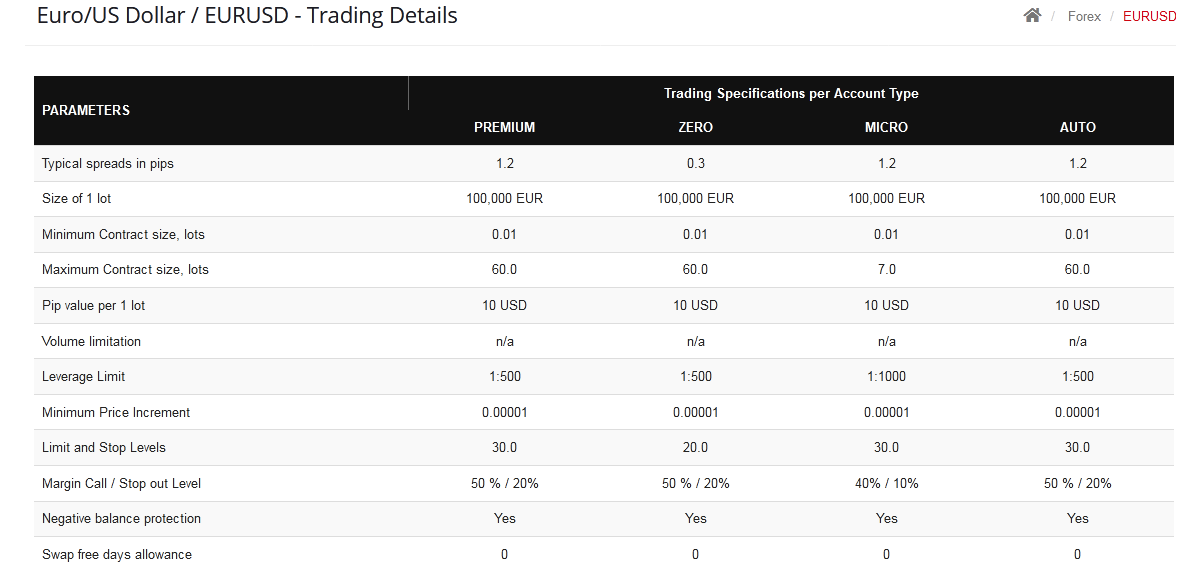

| 💵 Average EURUSD Spread | 1.2 pip (with Premium Account) |

| 📅 Year Founded | 2010 |

| 🌐 Website | www.hfm.com/ke |

| 💰 Minimum Deposit | Ksh700 |

| ⚙️ Maximum Leverage | 1:400 |

| ⚖️ Regulation(s) | CMA (Kenya), FSCA (South Africa), FCA (United Kingdon), CySEC |

| 🛍️ Trading Instruments | Forex, CFDs on Cryptos, Metals, Indices, Shares Commodities |

| 📱 Trading Platforms | HFM (HF Markets) MT4 and MT5 for PC, Mac, Web, Android |

| 📒 Demo Account | Yes |

| 💰 KES Base Currency | Yes |

Is HFM (HF Markets) Safe?

Let’s start with the regulation of HFM (HF Markets). HFM (HF Markets) is regulated by a number of regulatory bodies from across the world. But they are not regulated with Kenya’s regulator CMA.

Below are the three top tier regulations under which HFM (HF Markets) is regulated:

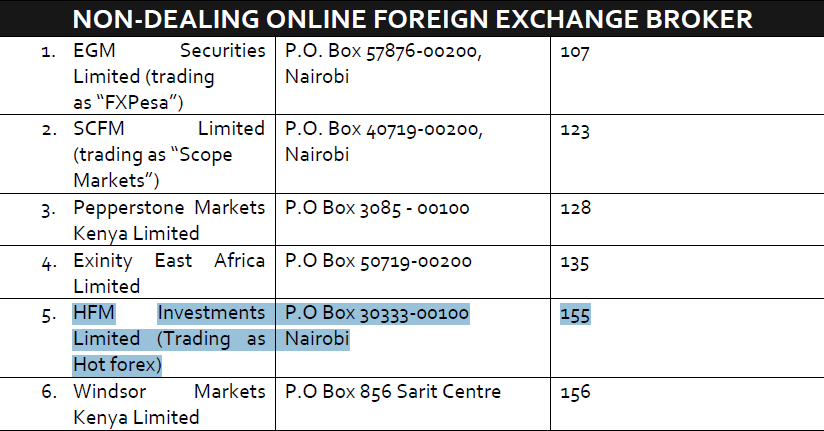

- Capital Markets Authority of Kenya (CMA): HFM (HF Markets) is regulated with local regulatory Capital Markets Authority of Kenya as HFM Investments Limited (Trading as Hot forex) with license number 155.

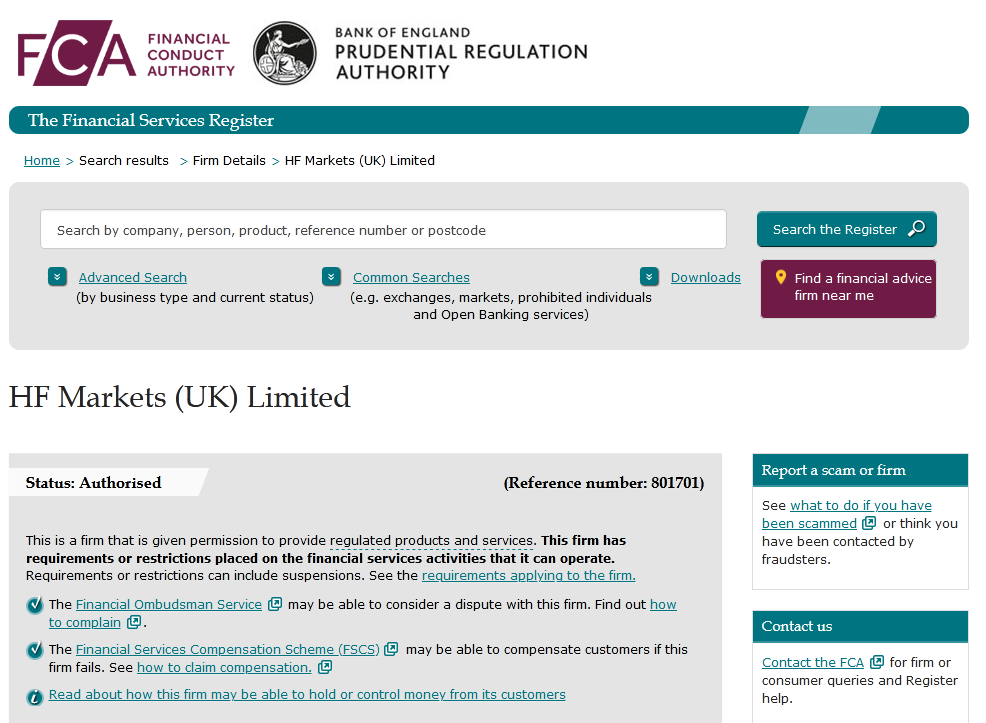

- Financial Conduct Authority (FCA), United Kingdom: HFM (HF Markets) is authorized and regulated by FCA with a firm reference number 801701. FCA is the market regulator in the UK, and is one of the leading industry standard regulator.

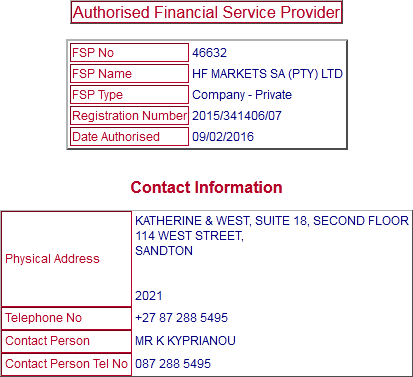

- Financial Sector Conduct Authority (FSCA), South Africa: HFM (HF Markets) is registered under FSCA, South Africa under the license number 46632.

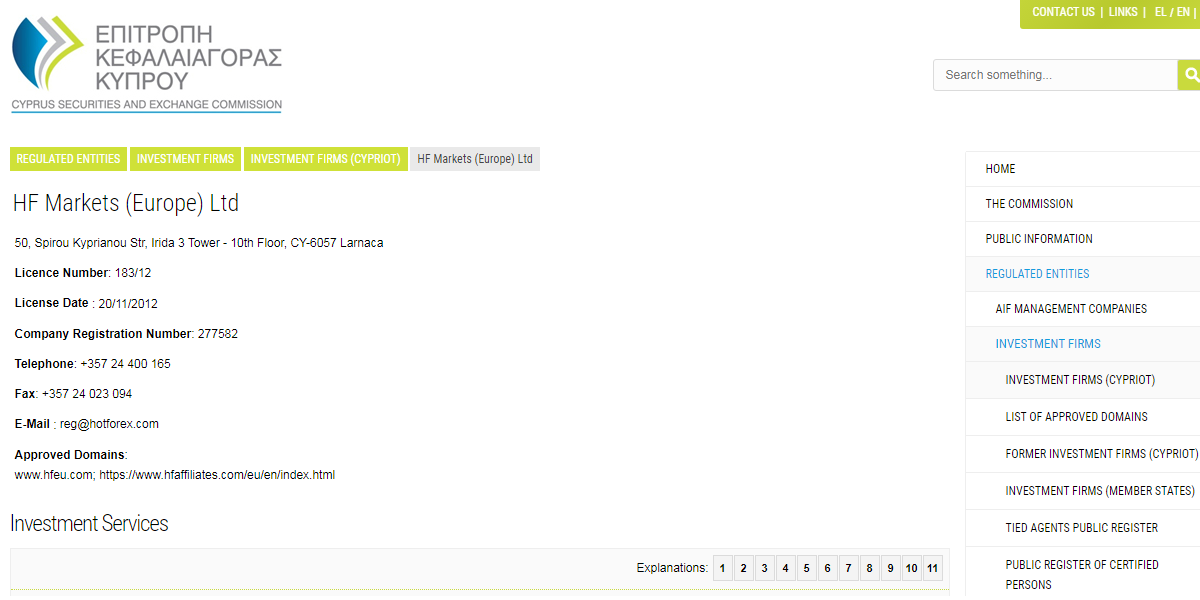

- Cyprus Securities and Exchange Commission (CySEC): HFM (HF Markets) is registered under CySEC with License Number: 183/12.

Safety of Funds

HFM (HF Markets) is also a very safe broker to invest the funds with because it has opted to safeguard its liabilities against clients and other third parties with a Civil Liability insurance program for a limit of €5,000,000. This insurance covers risk through errors, omissions, negligence, fraud, and other financial risks which may lead to financial losses.

HFM (HF Markets) also makes an effort to practice Segregation of funds by receiving Client funds into separate bank accounts, separate from the company account. These client accounts are off the records and are not taken into consideration in the balance sheet. Hence it cannot use the Client funds to pay back the creditors, in case of an unlikely event of default of the company. These points provide an added confidence and assurance to the clients to choose HFM (HF Markets) as their broker.

HFM (HF Markets) fees

There are mainly four types of fees that HFM (HF Markets) charges to its clients in different cases:

- Spread: HFM (HF Markets) charges the lowest average spread when compared to the other brokers. For example, for a major currency pair like EURUSD, the typical spread/fees charged on a Premium account is 1 pips per standard lot.

- Commissions: Commissions are charged on Zero account, which is a low-cost option with tight spreads. The fees charged is a sum of the spread and the commission on per Round turn. For example, for a EUR/USD pair, the fees would include a spread of 0.3 pips per lot and a commission of US$6 for a Round turn per lot.

- Rollover: A rollover fees is typically charged by all the brokers. It is basically the interest charged or earned for holding positions overnight (i.e. open positions). It is calculated based on the difference of interest rates of the two traded currencies. Buying a currency with higher interest rate and selling the lower interest rate currency would typically earn you rollover fees.

- Deposit & Withdrawal fees: HFM (HF Markets) does not charge any fees on deposit and withdrawals. If any fee is charged, it would be by the payment gateway vendors, bank or the credit card company. HFM (HF Markets) doesn’t cover these charges.

Apart from this, there is not much clarity on charges for account inactivity for any maintenance or administrative fee.

HFM (HF Markets) is a broker with minimum fee requirements and has low spreads and commissions, no deposit or withdrawal fee.

It is highly recommended and is a tested broker for both first timers and experienced traders.

HFM (HF Markets) Account Types

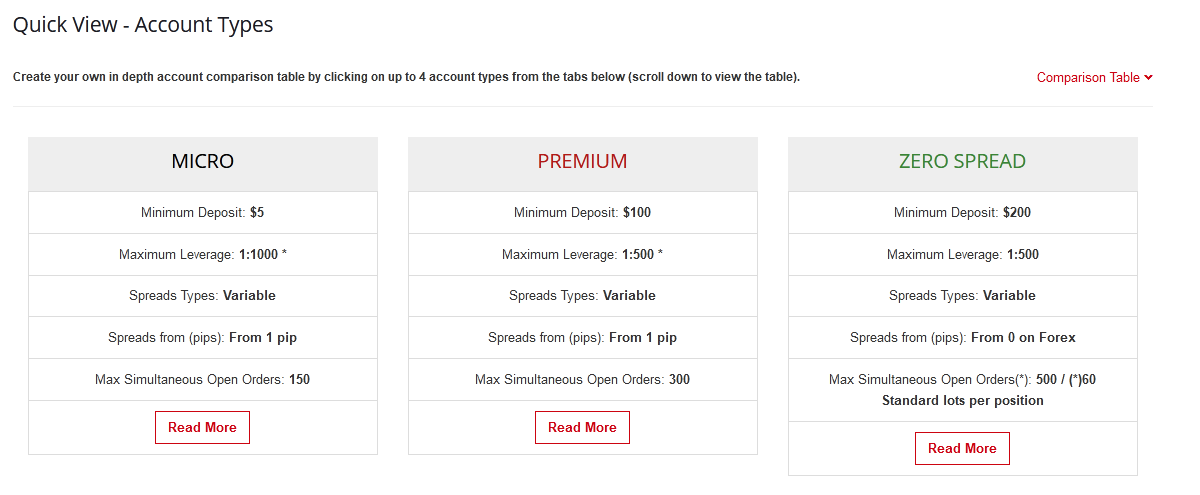

HFM (HF Markets) provides six types of accounts apart from a Demo account.

HFM (HF Markets) Demo Account

The Demo account is like a trial account with dummy money which can be created for practicing one’s trading strategies. There are many advantages of the Demo accounts.

These are just like live accounts with real market pricing, and unlimited usage, access to the MT4 & MT5 terminal and Webtrader platforms. There is a virtual opening balance of $100,000.

Now let us look at three live account types, Micro, Premium and Zero for a benchmark currency pair of EUR/USD.

HFM (HF Markets) Live Trading Accounts

- Micro Account: Micro Account has a minimum deposit requirement of KSh550 or US$5, provides a maximum leverage of 1:400, and is charged with a typical spread of 1 pip per standard lot for major pairs. There is no commission charged in this account.

- Premium Account: This account comes with a minimum deposit requirement of $100 or KSh11000, provides a maximum leverage of 1:400 and a typical spread of 1 pip per standard lot is charged. This account too has no commission charges.

- Zero Account: Starting with account requires a minimum deposit of KSh22000 or $200, with provision of maximum leverage of 1:400. There is a commission charge on this account and the total fees charged include a spread of 0 pips on EUR/USD pair and a US$6 commission on a Round Turn per lot.

t

How to Open account with HFM (HF Markets)

Account opening with HFM (HF Markets) is very simple. You need to follow the below steps for opening account with them:

Step 1)

HFM (HF Markets) Trading Instruments

There are a variety of trading instruments offered by HFM (HF Markets) for your trading needs. Let us look at them in detail:

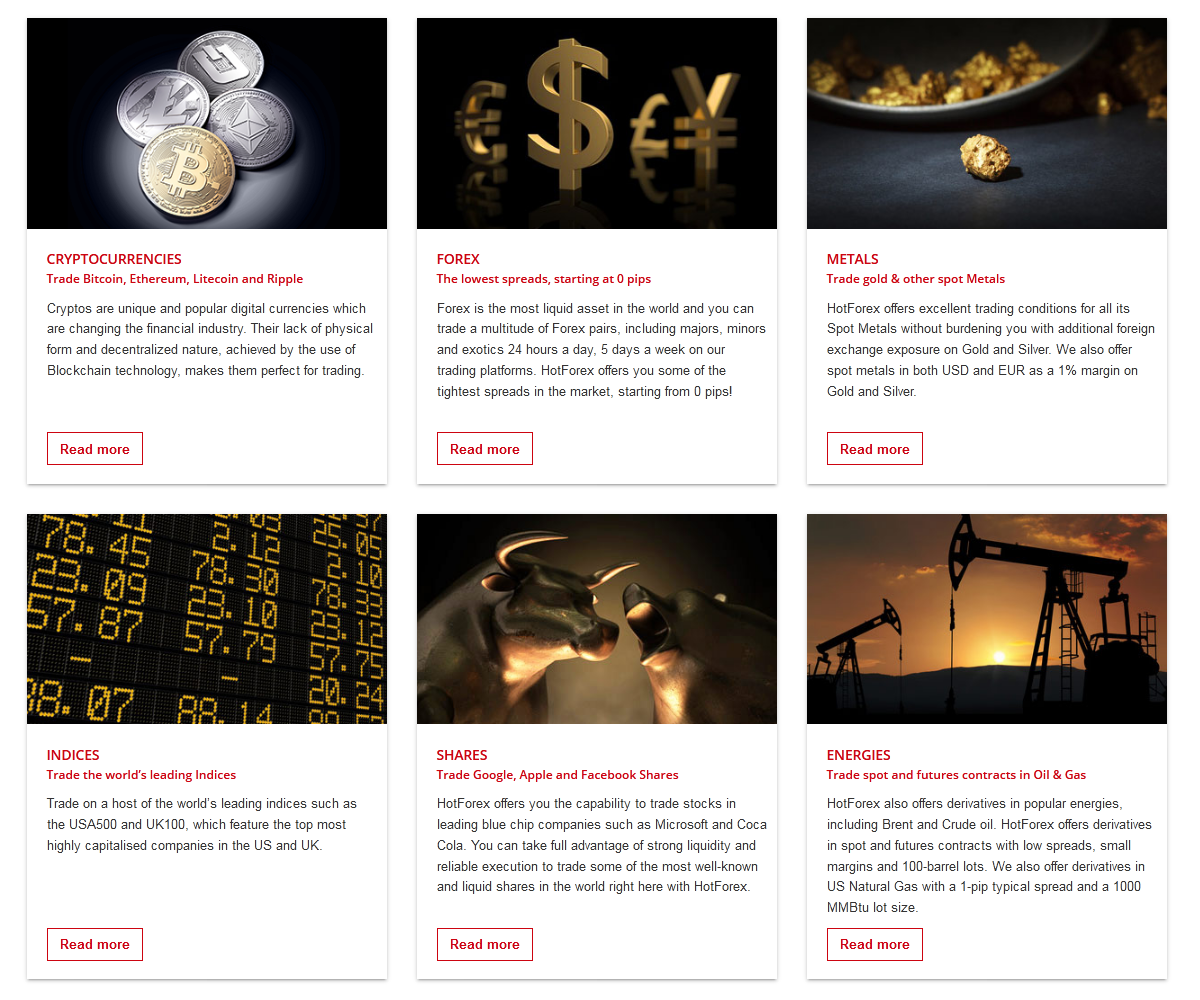

Forex: Forex is one of the most traded instruments and HFM (HF Markets) has a total of 50 forex pairs to trade, with some of the lowest spread in the market. There are currently 15 major pairs and 35 minor pairs on offer. Although some brokers offer higher numbers of FX pairs, this is still a wide variety of currencies for forex trading, compared to many other brokers.

- Metal CFDs: HFM (HF Markets) provides perfect trading conditions for Spot metals with additional features of Spot with a 1% margin on Gold and Silver CFD trading. There are at present four Spot contracts for metals trading.

- Energy CFDs: HFM (HF Markets) provides CFD trading on Oil and Gas with low spreads of Spot and Futures contracts. They offer small margins in oil and gas trading. There are two Spot contract specifications and three Futures contract specifications to select from.

- Commodities CFDs: Commodity trading can be done on HFM (HF Markets) for Spot contracts in Palladium and Platinum and for Futures contracts in Cocoa, Coffee, Cotton, Copper and Sugar. HFM (HF Markets) doesn’t charge commission on commodities and there is a very low deposit requirement.

- Indices: HFM (HF Markets) provides a wide range of top global indices to trade from. There are 11 Spot contract specifications and 12 Futures contract specifications on offer for trading in indices. Contract expiry dates are also mentioned for client needs and decisions. This makes HFM (HF Markets) quite a desirable broker.

- Shares: HFM (HF Markets) doesn’t fall short here also as they provide trading in equities market, with the option to trade on shares of top global companies. There are 56 company shares available with HFM (HF Markets). As a broker, they have included the exchange name, too, on which the particular stock is listed. This information is quite helpful while trading.

- Bonds: HFM (HF Markets) provides its clients three types of bonds options to trade in. They are Euro Bonds, UK Gilt and US 10-year Treasury Note. Bond calculations are clearly explained and expiry date information is also provided.

- CFDs on Cryptocurrencies: HFM (HF Markets) provides trading options in Bitcoin, Ethereum, Litecoin and Ripple. HFM (HF Markets) has 12 cryptocurrencies contract specifications.

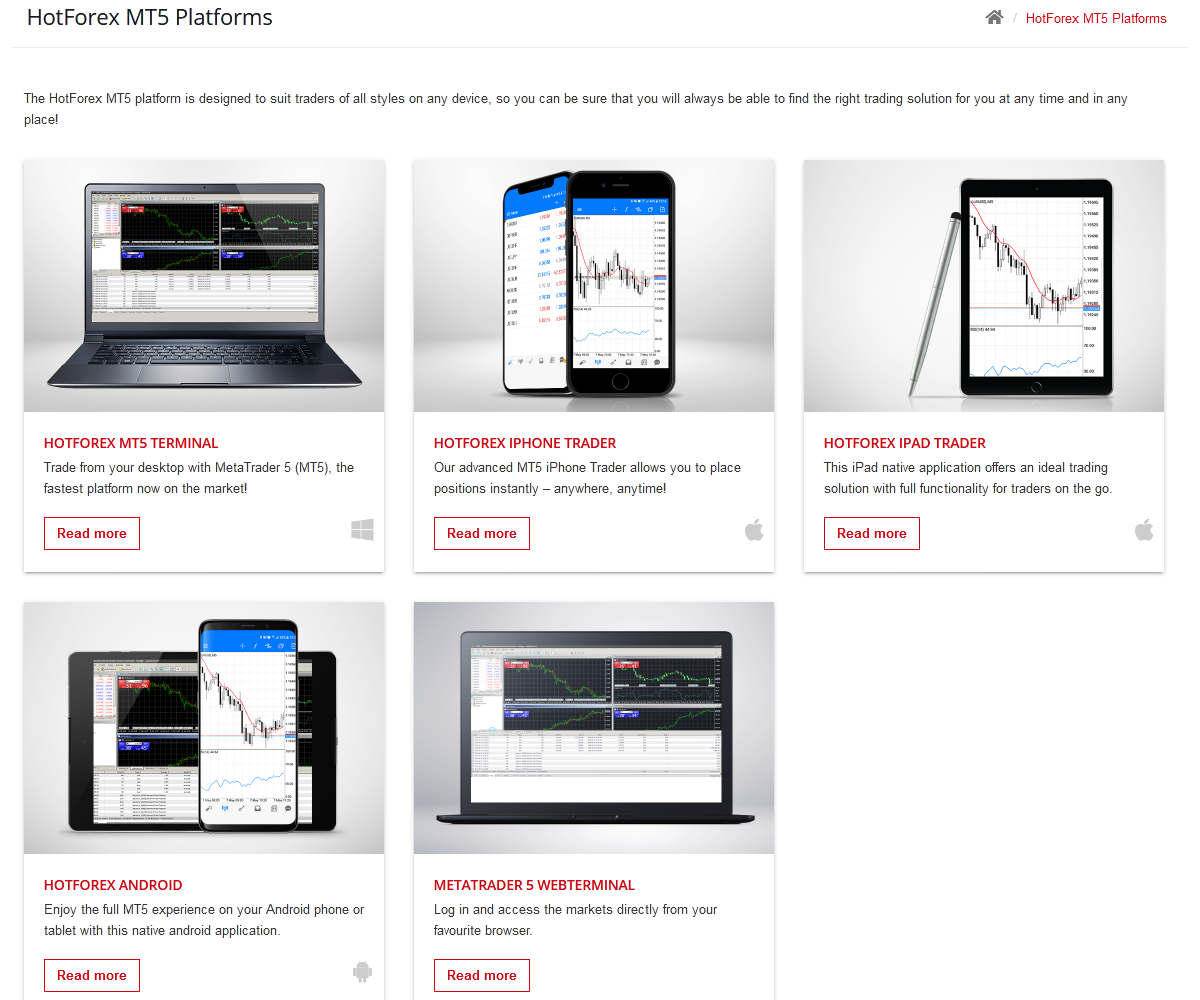

HFM (HF Markets) Trading Metatrader Platforms

HFM (HF Markets) provides its clients trading access on standard MT4 and MT5 platforms. Both the platforms have provision of access from desktop terminal, web terminal and on Android and iOS devices.

Apart from that, MT4 Multiterminal provides access to multiple accounts simultaneously. Both MT4 and MT5 have the required technical analysis tools and Expert Advisors options for better trading experiences.

HFM (HF Markets) Customer Support

The customer support at HFM (HF Markets) is quite good for traders in Kenya. We tested their Live Chat & Email support.

Here are the methods for support available at HFM (HF Markets).

- Live Chat Support: HFM (HF Markets) serve clients via Live Chat Support which is very good and quick responsive. You can contact them via Live Chat Support which is available 24/5 without any much response time.

- Contact Form: They also provide contact form on their website to receive message from clients. You can also send an email at [email protected]. They normally replied within 1 hours maximum.

- Phone Number: Anyone can call them at toll free number +44-2033185978 regaridng any query or issue. But there is no local phone number for Kenya’s clients.

Do we Recommend HFM (HF Markets) Kenya?

Yes, we do as HFM (HF Markets) is considered a trusted forex broker for trader in Kenya. HFM (HF Markets) is one of the popular CFD brokers in the world that is well regulated by multiple top-tier regulators.

Features which make HFM (HF Markets) stand apart are:

Highly regulated – HFM (HF Markets) is regulated by 3 of the top global regulatory bodies, the FCA of UK, the FSCA of South Africa and CySEC of Cyprus. It would have been great if HFM (HF Markets) was regulated by Kenyan Capital Markets Authority (CMA) too.

First hand customer service – 24/5 live chat support, fast and effective chat support, email support, as well as phone contact helpline.

Low and transparent trading fee – All the fees charged by HFM (HF Markets) are one of the lowest in the market, with a clear calculation on the spreads and commissions. Unfortunately, there is not much clarity on the Account inactivity and maintenance charges though.

Variety of trading instruments options – There are plenty of instruments on offer for trading apart from Forex, with extensive details on the expiry dates, calculation of the margin requirements and notional along with examples.

Additional features – HFM (HF Markets) also provides additional tools and education which help in better trading experience. Tools like VPS Hosting Services, Trading Calculator, Premium Trader Tools, Economic Calendar, Auto Trading, etc. aid trading in every way. The education part is also highly customized with e-courses, webinars, video tutorials and events.

Taking the above into consideration, we highly recommend HFM (HF Markets) forex broker for traders based in Kenya.

HFM (HF Markets) Kenya FAQs

What is the minimum deposit for opening account at HFM (HF Markets)?

Is HFM (HF Markets) a Legit Forex Broker?

Is HFM regulated with CMA in Kenya?

Does HFM have KES accounts?

How long does it take to withdraw funds from HFM (HF Markets)?

Does HFM (HF Markets) accept MPesa?

HFM (HF Markets) Kenya